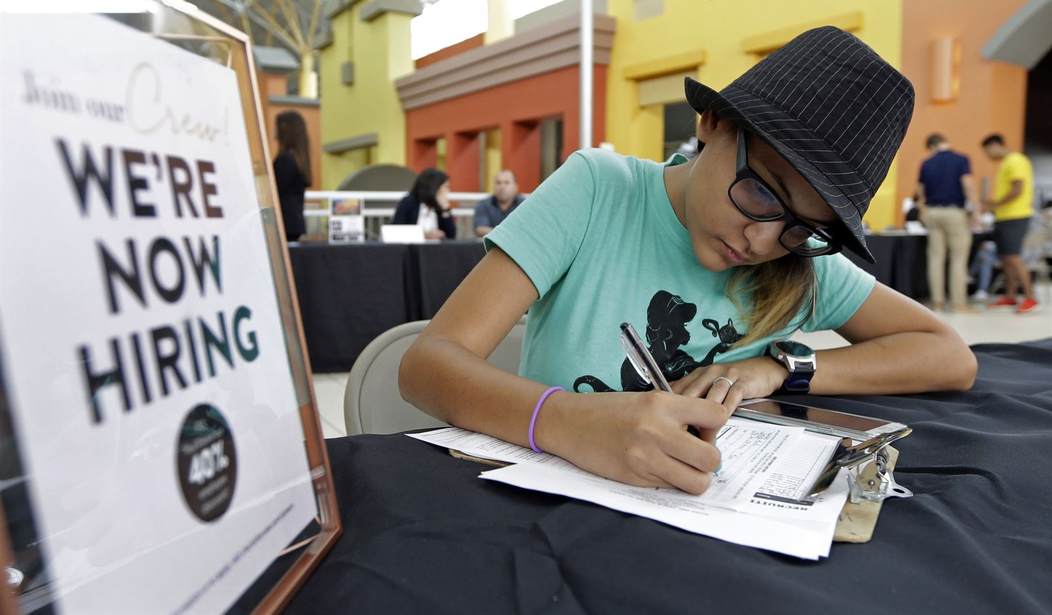

The number of Americans who applied for unemployment benefits rose for the third straight week to the highest level in three months as Joe Biden’s economy continues to sputter.

Despite nearly $5 trillion in stimulus since Dec. 2020, the U.S. economy is running out of steam. There was a brief spurt of job creation over the spring and summer and some economic growth, but the news on jobs continues to disappoint.

The four-week average of claims, which smooths out weekly volatility, rose by 20,000 to 231,000, highest since late November. Economists said that last week’s claims may have been inflated by the Labor Department’s attempts to tweak the numbers to account for seasonal variations; unadjusted, applications fell last week by more than 83,000.

“We could see one more week of notably higher claims before they should top out,″ analysts with Contingent Macro Advisors predicted. “This bears close watching going forward.″

The Federal Reserve might reconsider plans to ease its massive support for the economy if claims stay above 250,000 as the Fed’s March policy meeting approaches, Contingent said.

With inflation running at 7%, not raising interest rates to get it under control is extremely risky. We could actually see runaway inflation if the Fed decides to continue priming the economy instead of dealing with the inflation threat.

As far as any “recovery” is concerned, the economy will remain in the doldrums as long as millions of workers remain sidelined.

A complicating factor for employers and policy makers is the labor-force participation rate, which measures the share of the working-age population that is either employed or seeking employment. Though it has ticked up in recent months to 61.9%, it remains below the 63.4% level from February 2020.

Reduced savings and a rising share of household debt relative to income may bring more workers off the sidelines, especially given the expiration of many federal support programs, including enhanced unemployment benefits and more recently the beefed-up child tax credit, which Congress hasn’t extended.

“What’s missing in action here is any scent of federal stimulus which might delay a person’s decision to go back to work. That’s going to catch up to working families,” Ms. Richardson said.

Extending pandemic aid after the emergency had passed has caused far more complications than the simple-minded Democrats who advocated for all these extensions could ever imagine. And yet there’s talk of even more stimulus from Democrats.

We’re starting off 2022 with a surge of COVID-19 cases, fueled by the highly transmissible omicron variant. Health experts are saying that cases could peter off by late January. But if that doesn’t happen, and the outbreak persists, we may be in for months of disruptions.

That scenario could force businesses to shut down and layoffs to ensue. If that were to happen, and the economy were to decline, then it could make the case for another stimulus payment.

Uncle Sam would only cut another stimulus check because Joe Biden decided to shut down the economy. And if he tried that, he might as well roll out the welcome mat for Republicans who would replace a lot of Democrats in Congress.

Even if Republicans take control of Congress, it’s hard to see what they could do to get Biden to change course and stop the madness. It appears that the nation will have to endure Joe Biden’s economic policies until Jan. 2025 when his successor takes over.

Join the conversation as a VIP Member