Despite Joe Biden’s creepy and ultra-delusional pronouncement on Wednesday that “Today we received news that our economy had zero percent inflation in the month of July. Zero percent,” Americans know better. Truly, Biden thinks Americans are so economically illiterate that we’d believe “inflation is 0%” because it finally supposedly didn’t climb for one whole month. Seriously.

NOW – Biden: "Today we received news that our economy had zero percent inflation in the month of July. Zero percent." pic.twitter.com/HXpRy5xmW5

— Disclose.tv (@disclosetv) August 10, 2022

Meanwhile, out here in Real America (Yes, I happen to be in beautiful North Carolina at the moment and not the once-golden state of Commiefornia), the U.S. inflation rate still stands at a painfully high rate, causing average Americans much misery every day, and with every purchase. To paraphrase political consultant James Carville from 1992, no Grandpa Joe, Americans aren’t that dumb; we know that it is indeed the Bideninflation economy, stupid.

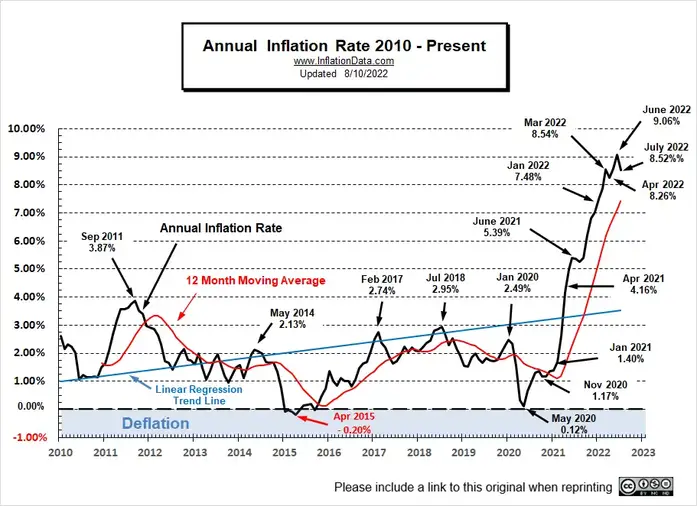

The U.S. government announced Wednesday that July’s federal inflation numbers decreased slightly to a still-decades-high of 8.52%. Granted, as my PJ Media colleague Stephen Green wrote, 8.52% “is better than last month’s 9.1% annual rate. But it still compounds on top of the ‘unexpected’ and ‘transitory’ and ‘high class’ 5.4% from this time last year.” It also still adds to the overall Misery Index.

Each month since the 1970s, economists have used the newly-released and updated Bureau of Labor and Statistics (BLS) data to quantify the economic health of the country. To do so, they add the current U.S. unemployment rate, which is a semi-stagnant 3.5%, to the current rate of U.S. inflation, which is a harsh 8.52%. The resultant sum produces a snapshot of the country’s economy. Originally coined by intellectual powerhouse and policy economist Arthur M. Okun in the 1970s as the “discomfort index,” the sum is now known simply as the U.S. Misery Index.

The current U.S. Misery Index stands at a still very miserable 12.02%.

So what exactly does the Misery Index tell us? First, we know that as the rate of inflation grows, the cost of living increases. Second, if the unemployment numbers also rise, more and more people fall into poverty. In theory, adding those two rates together gives us the Misery Index, which acts as a kind of snapshot in time gauging the health of the economy as a whole. In practice and since both unemployment and inflation significantly impact the average American wage earner’s spending power, the Misery Index also gauges how negatively Bidenflation has impacted the quality of American life. To put it another way, as the Misery Index climbs, the quality of American life declines.

With inflation at record-high levels not seen in decades, however, it follows that basic necessities like food, shelter, and fuel or gasoline would cost more for the consumer. In other words, American consumers are definitely feeling the pain of Bidenflation in their wallets with every purchase, even as Biden giddily touts July’s so-called 0% inflation.

Recommended: Port of L.A. Flooded with Cargo Nearly a Year After Biden ‘Fixed’ Supply Chain Crisis

And, while not perfect, the Misery Index is a useful tool to gauge the ups and downs of the U.S. economy under the Biden-Harris administration’s ruinous economic policies. With the soaring cost of living, most Americans are being forced to tighten their belts by cutting back on everyday expenses like groceries, gasoline, and housing. Simply put, inflation decreases the purchasing power of consumers for all purchases, not just luxuries.

According to the most recent Consumer Price Index news release, “the food index increased 10.9 percent over the last year, the largest 12-month increase since the period ending May 1979.” In addition, “the all items index increased 8.5 percent for the 12 months ending July” and “the all items less food and energy index rose 5.9 percent over the last 12 months.”

This begs the question: do any of those increases sound like “zero percent inflation”? I think not. In fact, Americans are feeling Bideninflation keenly and across the board. And, as experts like founder and CEO of Compound Capital Advisors Charlie Bilello pointed out, “US wage growth has failed to keep pace with rising prices for 16 consecutive months” now [emphasis mine]. So even as non-farm wages went up 0.15 cents in July, the American worker is seeing “a decline in prosperity.”

US wage growth has failed to keep pace with rising prices for 16 consecutive months. This is a decline in prosperity for the American worker and the primary reason why the Fed must continue to hike rates.

Charting via @ycharts pic.twitter.com/z1Q9TDx897

— Charlie Bilello (@charliebilello) August 10, 2022

Factor in, too, the rising and “wildly underestimated” housing prices, and we’ve got a recession or near-recession on our hands, folks, regardless of how Biden & Co. try to spin it. Housing is usually the largest expense at 33% of CPI, so “with rents up 12.4% over the last year and home prices up 19.7%,” tweeted Bilello, that “means that the true inflation rate is much higher than 8.5%.” As Bideninflation remains in the stratosphere and the feds consider raising interest rates, it seems pretty clear that Bidenflation is here to stay, no matter how the feckless Biden and his administration try to distract, gaslight, or deflect blame.

Buckle up, dear reader, because the bad news is that the road ahead is still quite bumpy. And while Carter-era misery seems here to stay for the near term, perhaps that Reagan-era prosperity a lot of us remember will return in the long-term especially if the left continues to step on their you-know-whats as they did this week with Mar-a-Lago-gate.

Join the conversation as a VIP Member