The countdown clock has been running a long time on this “bubblecovery,” and maybe it’s about to run out:

With homebuilder sentiment slipping,blamed on the weather (despite improvement in the Northeast), Architecture billings down, and lumber prices down, it should not be totally surprising that existing home sales collapsed in January (-4.9% against expectations of -1.8% to a worse than expected 4.82 million SAAR). This is the lowest existing home sales since April. Oh – and before the talking heads blame the weather – the biggest drop in home sales was in The West (with its warm, dry, sunny home-buying climate). Considering that existing home sales most recent peak in 2014 failed to take out the previous government-sponsored peak in 2013 and remains 30% or more below the 2005 peak, and claims that the housing recovery is in tact are greatly exaggerated.

If the housing bubble pops (again), I don’t know how the equities bubbles doesn’t pop (again), no matter how much liquidity the Fed pumps into a system which is already filled to the gills with liquidity.

Keep your fingers crossed a bunch of people (me included) are wrong about the nature of this “recovery,” because none of us really want to go through 2007-08 again.

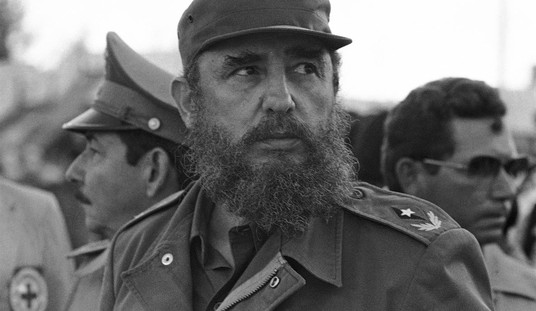

I mean, look what it brought us last time.

Join the conversation as a VIP Member