Build Back Better Light contained one of the provisions that caused backlash the first time Democrats proposed it. The Internal Revenue Service (IRS) received billions of dollars to conduct millions of new audits and hire at least 80,000 new agents. Even vulnerable Democrats have decided to ignore that nearly 60% of likely voters believe that federal agencies are too big and politicized. Sens. Joe Manchin (D-W.Va.), Kyrsten Sinema (D-Ariz.), and others up for re-election voted to make the IRS bigger.

We should review the more than doubling of IRS staff in context. As of 2021, the IRS had 81,600 employees. Adding 87,000 new staff members will exceed the current number. The total will end up near 168,000 IRS employees. Their mission is to wring every available penny out of working Americans to pay for Washington D.C.’s addiction to spending money they don’t have.

Some other numbers to consider:

- The Pentagon houses the Department of Defense headquarters and has approximately 27,000 employees. Its mission is “To provide the military forces needed to deter war and ensure our nation’s security,” and it performs this mission with about 16% of the IRS’s projected staffing.

- The State Department has 13,000 members of the Foreign Service, 11,000 Civil Service employees, and 45,000 locally employed staff. That agency’s mission is “To protect and promote U.S. security, prosperity, and democratic values and shape an international environment in which all Americans can thrive.” The State Department staffs more than 270 diplomatic missions worldwide with that number of employees and performs its mission with 41% of the projected IRS staff.

- Customs and Border Patrol (CBP) employed 64,272 people in 2021. With that number, the agency performs an impressive number of tasks on a typical day, fulfilling its mission to “Protect the American people, safeguard our borders, and enhance the nation’s economic prosperity.” The agency’s job became significantly more difficult after Joe Biden was elected, yet it continues trying to do it with 38% of the IRS’s anticipated staffing.

The IRS will have more employees than the Pentagon, the State Department, and CBP combined, thanks to this bill. These staff members will not be deployed to keep Americans safer, more secure, or more prosperous. The IRS’s sole mission is to maximize the amount of money it removes from your household in service of the government.

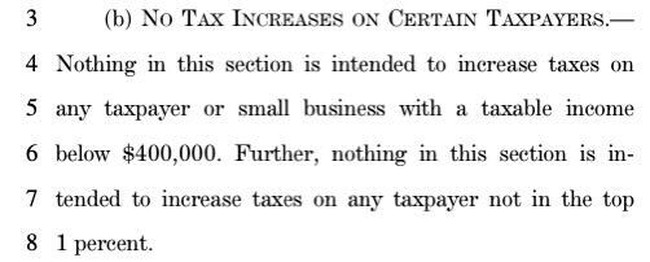

Related: Holy Crapo Amendment! Dems Reject Middle Class Protection from Doubled IRS

But don’t worry, Democrats say. They voted down Sen. Mike Crapo’s (R-Idaho) amendment that would have prohibited increasing audits on Americans making less than $400,000. But they put this in the bill:

We all know what is paved with good intentions. The Government Accounting Office (GAO) observed:

“From fiscal years 2010 to 2021, the majority of the additional taxes IRS recommended from audits came from taxpayers with incomes below $200,000. However, the additional taxes recommended per audit increased as taxpayer income increased.”

The IRS is fond of producing the percentage of returns that it audits at different income levels. The agency’s calculation never accounts for the fact that nearly 90% of American households make less than $200,000. Increasing the audit rates on the population earning less than $200,000 results in a much higher number of Americans getting audited.

According to the Joint Committee on Taxation, the Democrats’ intent is already evident upon passing the bill. According to the committee’s analysis, between 78% and 90% of the money raised from under-reported income would likely come from those making less than $200,000 a year. Only four to nine percent would come from those making more than $500,000. If you pay more, your taxes got effectively increased. And the IRS just got funding for 87,000 enforcement agents to add to the number of audits.

Reportedly, the agency has also been hoarding “weapons of war” and ammunition. The benign explanation for all of that could have been that the Biden administration was reducing firearms inventory. However, the entire picture takes on a darker tone after the raid at Mar-a-Lago Monday night.

The political nature of the IRS became apparent during the Obama administration. We all recall Lois Lerner and the agency’s admission of political bias. However, have you forgotten Dr. Ben Carson? Following his viral speech at the National Prayer Breakfast in 2013, Carson reported that his real estate holdings got audited. In the same year, two of Franklin Graham’s not-for-profits received audits. Both men had been operating for decades with no IRS issues.

Related: Why Does the IRS Need 5 Million Rounds of Ammo?

With multiple agencies weaponized, as we have seen clearly with the DOJ, FBI, and intelligence community, will the IRS pick up low-level enforcement? The FBI can’t arrest all of the regime’s opponents. It doesn’t need to. Enough tax liens, additional payments, and lengthy investigations will subdue most average Americans. The process is the punishment, and the IRS can bankrupt the average family faster than the DOJ bankrupted Gen. Michael Flynn.

According to Republicans on the House Oversight Committee, Democrats have vowed to revive their banking surveillance. You may recall that their initial Build Back Better proposal was to audit every banking transaction over $200. Supposedly that is why the IRS needed to double in size in the first place. And the IRS is doubling in size. Manchin and Sinema will obviously cave with the correct incentives. And you should not put anything past Democrats at this point.

Keep your receipts, and find a good accountant.

Join the conversation as a VIP Member