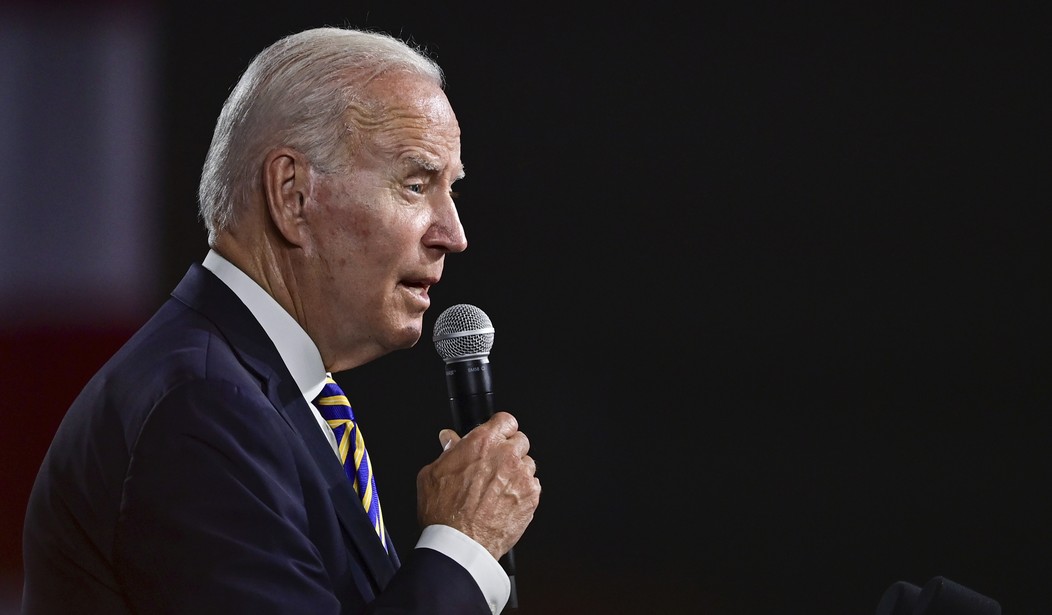

The horribly misnamed Inflation Reduction Act [sic] won’t raise taxes on a single American taxpayer who makes less than $400,000 a year, says Joe Biden and every other Democrat who talks about the bill.

But the Congressional Budget Office (CBO) begs to differ. In fact, the CBO calls Biden and the Democrats liars. Contrary to the assurances we get from Democrats on a daily basis that the bill won’t raise taxes on the middle class, the CBO has $20 billion reasons why the Democrats are fibbing.

An analysis by the CBO estimates those earning less than $400,000 — the group on which Biden promised not to raise taxes — will pay an estimated $20 billion more in taxes over the next decade as a result of the Democrat-pushed $740 billion package, which also sets aside $80 billion to hire 87,000 IRS agents.

The bill has yet to be scored in its entirety by the CBO — which typically gives each piece of legislation a price tag before it is voted on — but the agency scored the impact of the IRS expansion on middle-class taxpayers on Aug. 12 after a provision from Sen. Mike Crapo (R-Idaho) sought to exempt those making under $400,000 from increased IRS scrutiny.

Crapo’s proposed amendment would have kept those taxpayers from being targeted by the new IRS hires, but his provision was shot down 51-50 in the bill passed by the Senate last week.

The tip-off should have been the Democrats wanting to rush the bill through for a vote before the CBO was finished with its analysis. Just like Barack Obama knew his statement, “If you like your health care plan, you can keep it,” was a lie, Biden knows that his pledge not to raise taxes on taxpayers making less than $400,000 is a cynical sham.

The CBO analysis confirms an earlier report from the Joint Committee on Taxation that found that throwing an extra $80 billion at the IRS to improve the agency’s collection of under-reported income will end up targeting small business owners to pay for the legislation.

The reason is simple: small business owners’ money is low-hanging fruit for the IRS.

“Most small businesses are organized as pass-through entities — LLCs and S Corps,” James Lucier, managing director of Washington-based policy research firm Capital Alpha, told The Post. “Proponents of increased auditing specifically say they want to target pass-through entities, which inherently means targeting small business and small business owners.”

“The IRS will have to target small and medium businesses because they won’t fight back,” adds Joe Hinchman, executive vice president at National Taxpayers Union Foundation. “We’ve seen this play out before … the IRS says ‘We’re going after the rich’ but when you’re trying to raise that much money, the rich can only get you so far.”

The White House is trying the “Look! Squirrel!” defense. While denying the tax hike for Middle Americans, the administration claims that the CBO isn’t taking into account that the bill will offset costs for things like prescription drugs for average Americans.

Believe it when you see it.

Giving $80 billion to the IRS to increase enforcement is encouraging the agency to bully even more Americans. The notion that any good will come from this is absurd.

Join the conversation as a VIP Member