The 2017 Tax Reform Act cut federal taxes for the vast majority of Americans. But in a compromise with conservatives, there was a limit placed on deductions of state and local taxes, which somewhat eased federal budget deficit concerns. That limit of $10,000 has hurt high-tax blue states in the Northeast and elsewhere.

But the cap, known as SALT, may become part of the next “stimulus” bill as Democrats in Congress are looking to repeal it, or at least suspend the SALT provision in the tax act.

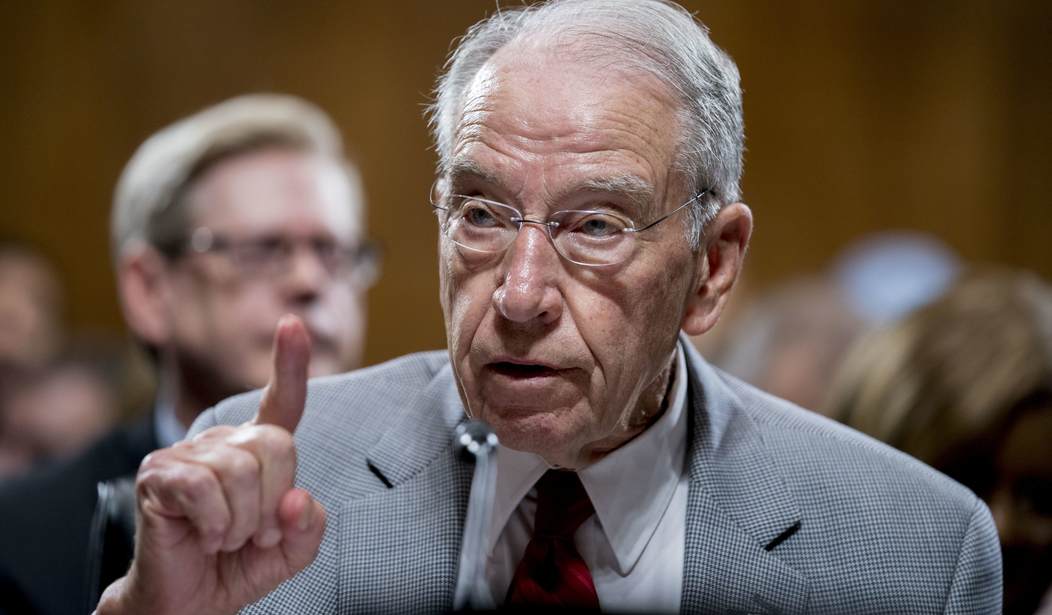

This didn’t sit well with Senate Finance Committee Chairman Chuck Grassley (R-IA).

“This is a nonstarter. Millionaires don’t need a new tax break as the federal government spends trillions of dollars to fight a pandemic,” a spokesperson for Grassley said.

Pelosi told the New York Times that if Congress repealed the cap and made it retroactive for 2018 and 2019, it would give Americans “more disposable income, which is the lifeblood of our economy, a consumer economy that we are.”

House Democrats have been trying to repeal the SALT cap without success. The cap is currently set to expire in 2025.

Grassley is absolutely correct. More than 90 percent of taxpayers are not affected by SALT. Only the wealthy benefit. Some of them are fleeing blue states for greener pastures.

Many wealthy residents have been moving out of those states and fleeing to states like Florida, which has no state income tax. Florida received more new residents than any other state last year, while New York’s outflows to the Sunshine State were the highest – 63,772 people. New York had the third-largest outflows of any state, with 452,580 people moving out within the past year.

Treasury Secretary Steve Mnuchin has suggested that if the states want to prevent this from happening, they should lower their taxes.

To which most of us would exclaim, “Duh.”

Pelosi can scream “fairness” all she wants; the facts are a little more prosaic.

A 2019 report from the Joint Committee on Taxation projected that of those who would face lower tax liability from elimination of the cap – which only affects those who itemize tax deductions – 94 percent earn at least $100,000. The government would lose out on $77.4 billion in tax dollars, with more than half of that amount being saved by taxpayers earning $1 million or more.

The cap on deductions isn’t going anywhere and, depending on who is in control of Congress in 2025 when the measure expires, it may go beyond that date.

Join the conversation as a VIP Member