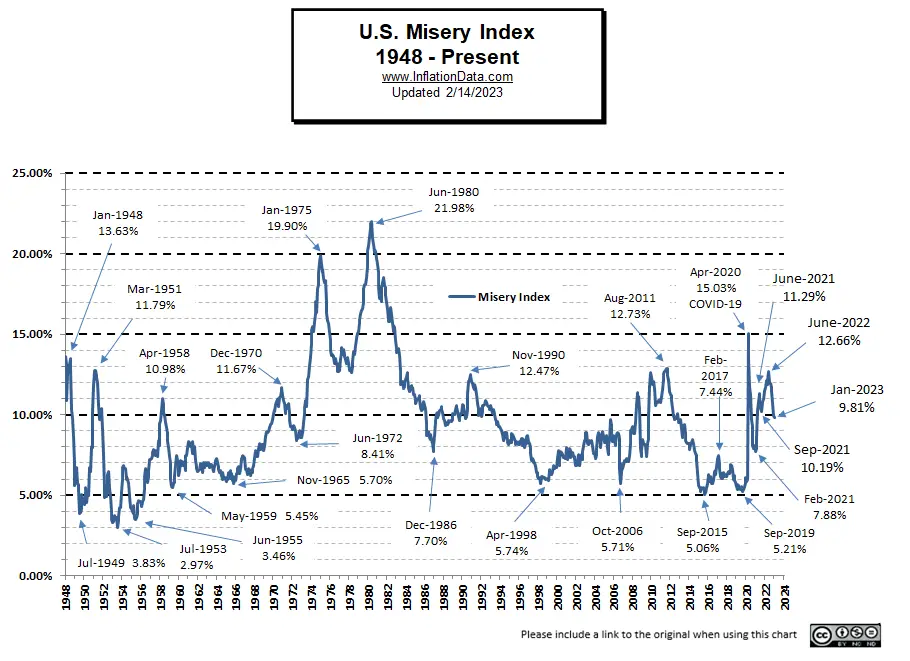

The U.S. Misery Index was a concept conceived by economist Arthur M. Okun in the 1970s to describe and quantify the level of economic distress experienced by everyday Americans. The index, while not perfect, can nonetheless be used as a powerful tool to help Americans and their leaders understand the existing economic forces affecting not only their lives but the financial circumstances of the country as a whole.

The index is calculated by adding the official U.S. unemployment rate to the U.S. inflation rate and is a popular indicator of economic health or distress. The higher the U.S. Misery Index, the more distress or misery there is in the economy as Americans struggle to make ends meet. Although initially coined “the discomfort index,” today the sum of these two rates is known simply as the U.S. Misery Index.

U.S. Misery Index = U.S. Unemployment + U.S. Inflation

Current U.S. Misery Index: Unemployment 3.4% + U.S. Inflation 6.41% = 9.81%

As the index rises, more and more people feel frustrated and anxious about their current and future economic opportunities. As Americans feel more anxious about the future, one of two things happens: either they curtail spending or they utilize credit spending, which increases their personal debt. And debt — as our leaders in Washington, D.C. don’t seem to know — only adds to financial misery.

As the graph shows, the index has fallen slightly over the past few months. So why are most Americans not feeling the misery ease? The answer, though complicated, lies mainly in the sleight-of-hand accounting methods of Biden & Co. As PJ Media’s Matt Margolis reported last week, we shouldn’t be fooled by these numbers because “Joe Biden’s relationship with the truth is not very good — particularly when it comes to the economy.”

Recommended: Prices Have Gone up 14.4 Percent Since the Adults Have Been Back in Charge

“We’ve created 12 million — 12 million — jobs since I took office,” Biden has claimed. “That’s the strongest two years of job growth in history by a long shot.” According to Biden, “he’s created 12 million new jobs, even though about 10 million of those jobs were lost during the pandemic, and the 2 million others haven’t even kept up with population growth.”

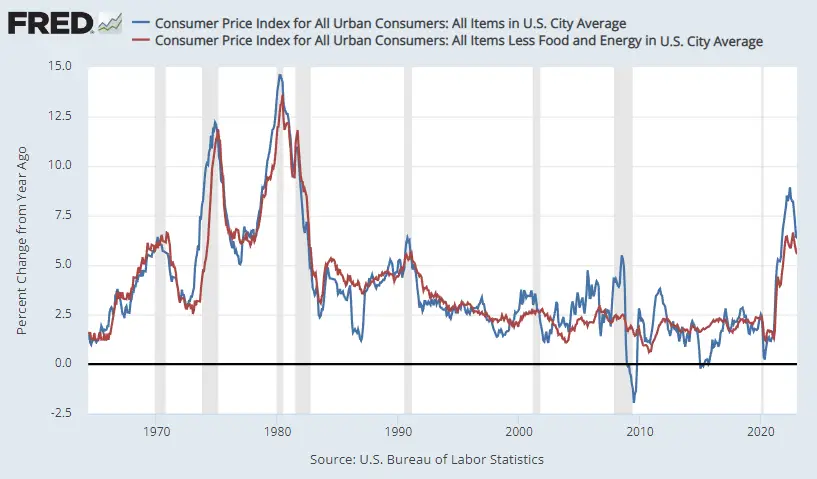

Those unemployment numbers are obviously a bunch of malarkey, Jack. So what about the numbers on the other side of the index equation regarding inflation? Matt Margolis fact-checked Biden’s claims about inflation levels as well.

Biden falsely claims inflation was high when he took office.pic.twitter.com/zJeXF38IEk

— Matt Margolis (@mattmargolis) February 3, 2023

In fact, when Biden took office inflation “was a mere 1.4%, which was on par with the average inflation rate of 1.2% for all of 2020 and was the lowest monthly inflation rate of Biden’s entire presidency.” Later, inflation rose to a high of 9.1% in June of 2022, and now in January 2023 inflation is fairly stagnant at 6.41%. On what planet are 6.41% inflation and the higher prices it brings for consumers something to cheer about? Planet Biden, apparently.

No matter how you slice it, Americans continue to feel economic misery from Bidenflation because even though the rate of inflation has been falling recently, prices are still rising on just about everything. In other words, with prices 6.41% higher today than they were one year ago, the decline in the inflation rate from 6.45% to 6.41% feels like no decrease at all to American wallets as wages continue to lag as well.

Join the conversation as a VIP Member