While Joe Biden’s White House intern continues a pernicious “good news” social media spin-blitz, the likes of which we’ve not seen before, everyday Americans are not actually experiencing any “real breathing room” in the suffocating Biden economy. They are, in fact, miserable.

Today we have some good news about the economy: For the sixth month in a row, yearly inflation is down.

Inflation might be rising in economies around the world, but it’s coming down in America month after month, giving families some real breathing room.

— Joe Biden (@JoeBiden) January 12, 2023

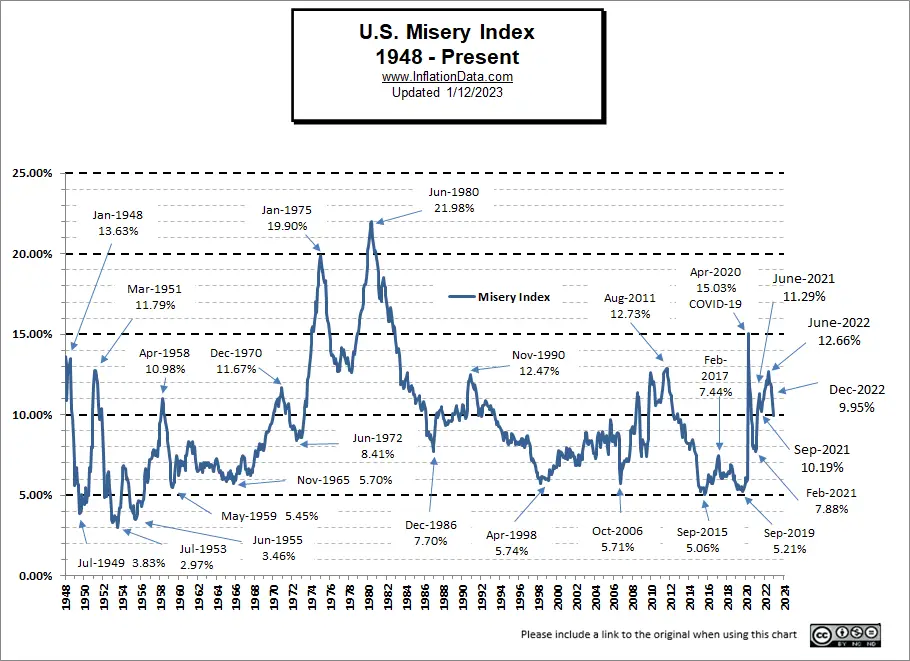

In truth, the health of the economy can be quantified not by deceptive tweets but by adding the most recent Bureau of Labor and Statistics (BLS) rate of U.S. unemployment, a stagnant 3.5% to the rate of U.S. inflation for December, a still-high 6.45%. The sum of these rates functions as a snapshot in time of America’s economy as a whole. Although originally coined “the discomfort index” by policy economist Arthur M. Okun in the 1970s, today, the sum of these two rates is now known simply as the U.S. Misery Index.

Current U.S. Misery Index: Unemployment 3.5% + Inflation 6.45% = 9.95%

Since unemployment and inflation significantly impact the average American wage earner’s spending power, the Misery Index is a useful gauge of the negative impacts of Bidenflation on the quality of American life. Sadly, that decline is evident each and every time Americans go to the grocery store or the gas station and when they pay their household bills. And even though December inflation rates crept down slightly from last month’s 10.81%, Bidenflation is still at 40-year highs.

Recommended: Big Tech Culls Its Herd

Simply put, most Americans aren’t feeling Biden’s so-called “breathing room” just because Bidenflation is not currently “rising” like “economies around the world.” You see, in Biden’s America, he believes we should somehow be grateful that inflation is only 6.45%. Whatever we do, we should focus on the twenty-one economies with higher inflation rates than the U.S. We absolutely shouldn’t notice there are also twelve countries with lower inflation rates than the U.S. I mean, c’mon Jack.

Global Inflation Rates… pic.twitter.com/F50Or8CVqZ

— Charlie Bilello (@charliebilello) January 16, 2023

No matter how Biden & Co. spin it, the U.S. economy shows no signs of lasting recovery. For instance, even after several consecutive rate hikes, on February 1, the Fed is expected to once again raise interest rates about 0.25% putting them at 4.50% to 4.75%, near highs from the early 2000s and higher still than the Fed’s preferred 2% target rate. How on earth can this be “good news” for American businesses and consumers?

Meanwhile, the U.S. hit its debt ceiling, and the U.S. Budget Deficit (when spending exceeds revenue) is growing ever wider at over $421 billion so far this year. And last but not least, the National Debt (the collective amount of money the government has borrowed) climbed to over $31.46 trillion — which doesn’t even take into consideration our obligations for Social Security, Medicare, and government pensions, but if it did, that would triple the National Debt.

The US Budget Deficit is widening again, hitting a 9-month high of $1.419 trillion in December (YoY change). pic.twitter.com/L0mAxmxJvT

— Charlie Bilello (@charliebilello) January 13, 2023

As bleak as all that sounds, surely there’s “good news” for the economy in housing. Well, not so much. Rising mortgage rates have put a major damper on the sales of existing homes. According to the founder and CEO of Compound Capital Advisors Charlie Bilello, “2 years ago: 30-yr mortgage rate was 2.77% & median existing-home price in the US was $304k. Today: 30-yr mortgage rate is 6.15% & median existing-home price is $367k.”

The result is a “$13k increase in down payment (20% down) and 80% increase in monthly payment (from $995 to $1,788).” Add that to rising rent rates, and most Americans are looking to keep the roof they already have over their heads and are not in a position to buy a new one.

US Existing Home Sales decrease – largest ever annual decline🔥🔥🔥 pic.twitter.com/J4LGWGRYxS

— Wall Street Silver (@WallStreetSilv) January 20, 2023

What about food? Surely, Americans are okay there? Nope. The most recent BLS news release stated that “consumer prices for all items rose 6.5 percent from December 2021 to December 2022. Food prices increased 10.4%, reflecting an 11.8% increase in prices for food at home and an 8.3% increase in prices for food away from home.”

The Consumer Price Index (CPI), which measures the overall change in prices consumers paid for goods and services, fell 0.1% in December. During the same period, the prices for shelter (↑0.8%), food (↑0.3%), and apparel (↑0.5%) were the largest contributors to the monthly seasonally adjusted all-items increase. Recreation (↑0.5%), personal care (↑0.7%), medical care (↑0.1%), and electricity (↑1.0%) were among those that also increased over the last month. Used cars and trucks (↓2.5%), gasoline (↓9.4%), and airline fares (↓3.1%) saw a decrease. Meat/Poultry/Fish prices are up by a percentage point, and eggs alone rose an incredible 11.1%. Tell me again how this is “good news.”

Anyone saying inflation is easing doesn’t buy their own groceries.

— Catturd ™ (@catturd2) January 19, 2023

As food prices continue to climb along with housing and energy, coupled with lingering supply chain issues (Dude, where’s my oven I ordered almost three months ago?) and the dollar at a seven-month low, just how are American families coping with all this Bidenflation?

US wage growth has failed to keep pace with rising consumer prices for a record 21 consecutive months. This is a decline in prosperity for the American worker and the primary reason why the Fed will hike rates for the 8th time at the Feb 1 meeting. pic.twitter.com/HJ04xUqPY3

— Charlie Bilello (@charliebilello) January 12, 2023

The answer is: not very well. They’re coping with twenty-one consecutive months of lagging wages and by utilizing credit, of course. I don’t know about you and your family, Mr. Biden, but I don’t find much to breathe easy about in falling savings, rising debt, and declining prosperity. Are we Americans better off than we were two years ago? Clearly, we are not, and Lord help us if we have two more years of this “good news” economy.

Join the conversation as a VIP Member