I’ve spent so much time writing about inflation these last few months that it’s been almost tempting to put on a leisure suit and light my office with a disco ball.

Almost.

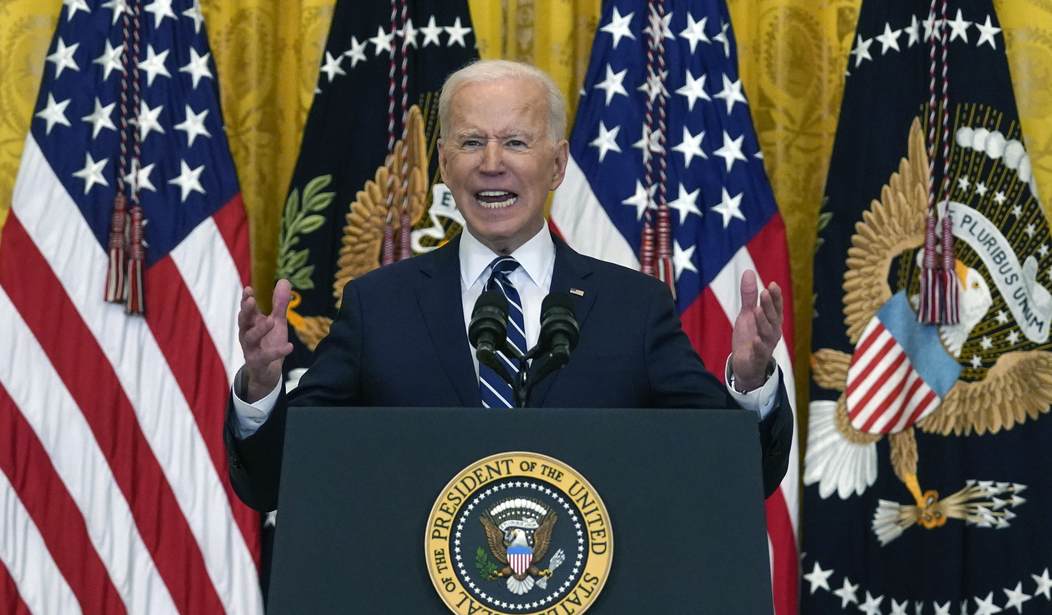

Judging by Presidentish Joe Biden’s awful and awkward speech on Monday, there’s at least a mild panic in the White House over the surge in consumer prices — and the even bigger (but rarely addressed) spike in producer prices.

Last week you could see the panicked writing on the Oval Office wall.

ASIDE: I almost wrote “Oval Office walls,” but if you think about it, there’s only one.

While PJ Media’s own Tyler O’Neil has the full details on Biden’s stock-market-rattling speech, it’s the motivation behind it that interests me.

As I write this, the Dow is down about 2.5%, NASDAQ has shed about 1.5% of its value, and the S&P is down more than 2%. Those numbers have been getting worse all day — they didn’t recover any after Biden finished mumbling his way through yet another set of pointless remarks.

The White House had to know it was taking a big risk with the markets, giving Biden a microphone and the sad duty of at least tacitly admitting that the inflation threat is real. (Plus, unnecessarily working up fresh COVID panic, but that’s a subject for another column.)

Despite weeks of official denials that the months-long inflationary surge was only “temporary,” White House economic officials Brian Deese and Cecilia Rouse felt it necessary to meet last week with Larry Summers.

Why is that revealing?

Summers isn’t merely a former Treasury secretary under Bill Clinton and onetime economic advisor to Barack Obama, he’s also a longtime inflation hawk whom Democrats are “angry” with over his recent warnings.

MSN News described Summers as “the most prominent Democratic critic of Biden’s economic agenda,” who “blasted the size of the March economic relief bill.”

My guess is that Biden’s people got an earful from Summers, so much so that they felt they had to get out in front of this thing.

It doesn’t take a big imagination to guess that after a weekend of testing out one weak take after another, they trotted out Slow Joe on Monday to say he’s “confident” that “unchecked inflation… isn’t what we’re seeing today.”

Well, we might not have reached “unchecked inflation” just yet, but Biden’s “Build Back Better” agenda has set our country on the fast track there.

While digging up info for this column, I came across some shocking numbers courtesy of Zero Hedge:

There was a remarkable statistic in the latest Flow Show report from BofA’s Michael Hartnett: according to the CIO’s calculations, “the Fed is spending $336 million every 60 minutes buying bonds, while the US federal government is spending $875 million every hour this year”, a staggering amount made possible only by the recent merger between the Fed and Treasury which ushered in not only helicopter money but its socialist offshoot, MMT.

Usually, when Washington borrows money, they borrow it from banks, investors, etc. Money leaves lenders’ hands and goes to into the government’s hands, with a negligible inflationary effect because the number of dollars rolling around remains unchanged.

But since 2007, the Fed has become the lender of first resort. The Fed whips up money out of thin air, then lends it to the Treasury — to the tune of a billion dollars every three hours.

That’s more than eight billion dollars in inflationary make-believe money, every day, seven days a week.

If Hartnett’s numbers are correct (and they are), not only is Washington spending at an unprecedented rate, they’re printing that way, too. Nearly 39 cents of every dollar is magical Fed money.

It adds up.

Remember, too, that Biden is just getting started on his agenda. The $1.9 trillion “relief” package from March is dwarfed by the $3.5 trillion Democrats plan to spend on their “infrastructure” bill.

Total federal spending for an entire year didn’t reach $3.5 trillion until 2016, but the Democrats plan to spend that much more in a single bill that sits on top of this year’s record-busting budget.

The White House is panicked for exactly one reason.

They’ve been spending like criminals based on the “Modern Monetary Theory” (or MMT) that “debt is simply money that the government put into the economy and didn’t tax back.” In other words, Washington can spend as much as it likes and inflation won’t be a problem.

Well, it took only a few months and not even one-third of Biden’s first-year spending agenda to prove MMT wrong.

Inflation is here, and the White House is worried that in 2022 it will cost them Democrat control of Capitol Hill…

…and in 2024 inflation will even destroy reelection hopes for Kamala Harris.

I’m merely being snarky on that last point.

Mostly.