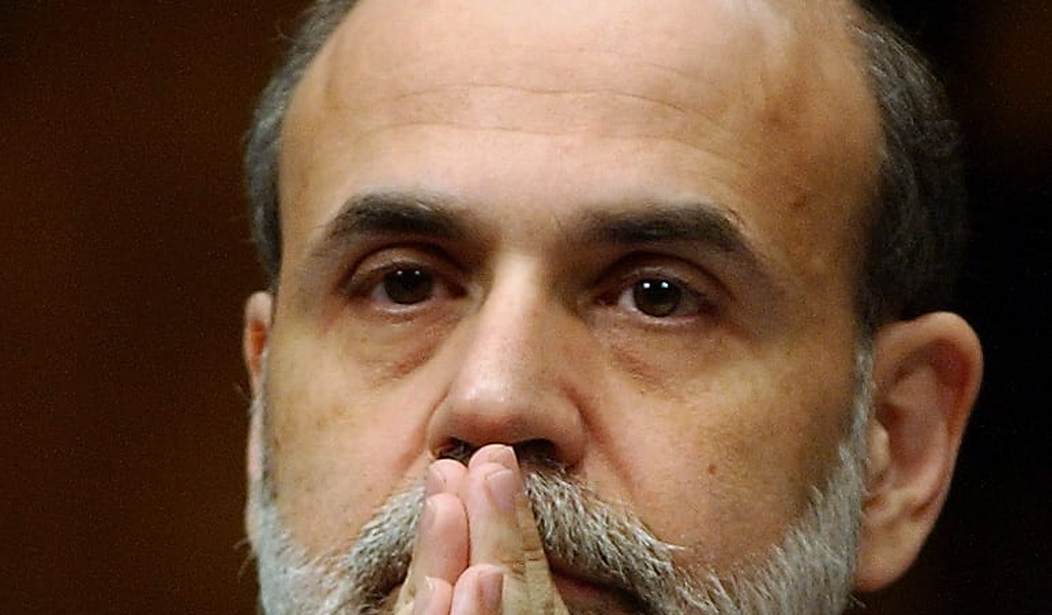

WASHINGTON – Fed Chairman Ben Bernanke cautioned Congress last week that the Fed will not allow interest rates to rise closer to historical levels because of the risks of moving too aggressively or prematurely.

The Fed chief, however, also said the Fed could take a step down in its pace of bond purchases in the next few meetings, making the stock market react wildly to the conflicting signals sent by the Fed and Bernanke himself in recent weeks.

Bernanke told Congress the first step in the Fed’s exit strategy would be to wind down the quantitative easing program. As part of this program, the Fed has been buying $85 billion a month in Treasury and mortgage bonds since September. This has lowered long-term interest rates and encouraged more borrowing and spending in the U.S. economy.

“As the economic outlook and particularly the outlook for the labor market improves in a real and sustainable way, the committee will gradually reduce the flow of purchases,” said Bernanke.

He also reiterated that any change in the flow of bond purchases would depend on the incoming data and the Fed’s assessment of the labor market and inflation. As Bernanke hastened to note during his testimony to the Joint Economic Committee last week, the Fed does not want to move prematurely because of the danger of ending the economic recovery.

As the Fed approaches the time when it will begin withdrawing its accommodative policies, the central bank must also decide how quickly to wean the economy from the bond purchases. If the Fed acts too quickly to restore normality in monetary policy, it risks halting the economic recovery. If it acts too slowly, risks of inflation may increase along with the probability of destabilizing asset bubbles. This makes a good communications strategy key to maintain credibility with the private sector and bond markets.

“This is not easy and requires good communication,” said Bernanke, when asked about the possible market turmoil the central bank could cause when it starts selling its portfolio. “We are currently discussing further our exit strategy, and we hope to provide more information going forward. But we certainly are confident that we can exit over time in a way that will be consistent with our policy objectives.”

Communications are very important for the central bank because they can shape expectations about the course of inflation and borrowing costs, and thereby influence actions by households, businesses, and investors. Unlike his predecessor Alan Greenspan, who deliberately delivered wordy and vague statements to prevent financial markets from overreacting to his remarks, Bernanke has made an effort to bring a new level of transparency to Fed communications.

Nevertheless, the straightforward message has been blurred by a number of other signals sent by Bernanke and by the Fed in recent weeks. Minutes of the Federal Open Market Committee’s last meeting showed disagreement among members of the board about what evidence would demonstrate that the economy is on a path of strong and sustainable growth. The minutes also indicated that a number of participants expressed their willingness to adjust the flow of purchases downward as early as the next meeting, if the economic data received at that time showed evidence of improvement in the economy. The Fed will meet on June 18-19 to decide its course of action.

Sen. Pat Toomey (R-Pa.), who commended Bernanke for his efforts at greater transparency, expressed his concern over the unpredictable ways in which the Fed’s “extremely accommodative policy” may manifest itself.

“I think it’s important to underscore that it’s hard to predict how the markets will respond when the biggest holder of fixed income securities in the history of the world decides it has to sell them, and you might decide you have to sell them,” Toomey said. “I know you may decide you can just let them run off, but that may not be enough and I just think there’s very significant risks that we’re taking by accumulating a portfolio of this scale.”

The financial sector has benefited from the unconventional monetary policy adopted by the Fed, which has helped the stock market index move to all-time records this year. Any hint that the central bank is planning to reverse its current policy is bound to send jitters through financial markets, which is exactly what happened last week after Bernanke’s statement at the hearing. Stocks surged after Bernanke began speaking at 10 a.m. when he sounded reluctant to start reducing the size of the monthly purchases, gradually fell as he began sounding like he was entertaining the idea, and then they turned negative in the afternoon, following the release of the minutes of the Fed’s last meeting in May.

Bernanke noted that the economy and the job market have shown signs of renewed strength. The economy has added an average of 208,000 jobs per month since November. That is considerably above the average of 138,000 during the previous six months. Rising consumer confidence and renewed housing market activity, along with the Fed’s stimulus actions, have benefited the economy. These gains, in part, are why critics of the bond purchases have argued that keeping interest rates low for too long could spike inflation or create bubbles in the financial and housing markets.

Rep. Kevin Brady (R-Texas), one of these critics, tried to press Bernanke on exactly when he would begin to tighten bond purchases, asking him if it would happen before Labor Day. Brady also asked how much notice the Fed planned to give the market before executing its exit strategy.

The Fed chief responded by saying: “Well, we’ve explained the strategy. And, again, the market can see the data as well as we can. And what we are looking for is increased confidence that the labor market is improving and that that improvement is sustainable.”

Most of Bernanke’s testimony focused on the many risks facing the economy. In particular, he bemoaned the government’s austerity program by sounding the same message he has repeated in the past couple of years.

“To promote economic growth and stability in the longer term, it will be essential for fiscal policymakers to put the federal budget on a sustainable long-run path,” Bernanke said.

The Fed chief said the objectives of effectively addressing longer-term fiscal imbalances and minimizing the near-term fiscal obstacles facing the economic recovery are compatible.

“To achieve both goals simultaneously, the Congress and the administration could consider replacing some of the near-term fiscal restraint now in law with policies that reduce the federal deficit more gradually in the near term but more substantially in the longer run,” he said.

The Commerce Department said on Friday that consumer spending fell in April for the first time in almost a year. The weak spending and the lack of inflation pressures should help dampen concerns the Fed might start scaling back its bond-purchasing program anytime soon.

Join the conversation as a VIP Member