Unions are getting a free pass after mismanaging their multi-employer pensions for decades. In a provision not well-publicized before the stimulus bill narrowly passed by the Senate with only Democrat support, $86 billion dollars will be directed to at least185 multi-employer union pension plans that are close to collapse. According to the New York Times:

Both the House and Senate stimulus measures would give the weakest plans enough money to pay hundreds of thousands of retirees — a number that will grow in the future — their full pensions for the next 30 years. The provision does not require the plans to pay back the bailout, freeze accruals or to end the practices that led to their current distress, which means their troubles could recur. Nor does it explain what will happen when the taxpayer money runs out 30 years from now.

The pension crisis is not new and fixing it has long been a Democrat priority. Congress passed legislation in 2014 to allow insolvent pensions to pare benefits within limits to prevent bailouts by the taxpayer. However, President Obama’s Treasury Department blocked the Central States Pension Fund’s plan to use the law in 2016. The media framed this denial as an attempt to force a straight bailout, and here we are.

At the time, the responsibility to cover the fund’s projected insolvency would have fallen to the Pension Benefit Guaranty Corporation (PBGC), which had its own insolvency issues. The Central States fund was paying $3.46 in benefits for every dollar it took in due to an aging former workforce and employer withdrawals:

Legislators thought they fixed this problem late in 2014 when they attached bipartisan legislation to the so-called “cromnibus” spending bill. The pensions amendment allowed trustees for financially troubled multiemployer pension plans to cut vested benefits, provided they could demonstrate to Treasury that doing so would prevent the plan from going bust. The idea was that the cuts would prevent a far worse fate — a Central States bailout by the Pension Benefit Guaranty Corporation, which would pay only pennies on the dollar (and which had solvency problems of its own). According to a recent PBGC report, “it is more likely than not that PBGC’s multiemployer fund will be exhausted by 2025.”

Joshua Gotbaum, former director of the PBGC, called the Treasury Department’s decision an “act of political cowardice” that will result in “more and deeper benefit cuts” to Central States beneficiaries.

The PBGC board of directors consists of the secretaries of Labor, Commerce, and Treasury, with the secretary of Labor as chair. It is not supposed to be funded by taxpayers and covers payments to failed employer pensions. From their website:

In fiscal year 2020, PBGC paid for monthly retirement benefits, up to a guaranteed maximum, for more than 984,000 retirees in more than 5,000 single-employer plans that cannot pay promised benefits. Including those who have not yet retired and participants in multiemployer plans receiving financial assistance, PBGC is responsible for the current and future pensions of more than 1.5 million people.

The PBGC handles multi-employer and single-employer plans through separate programs. The current legislation will provide $86 billion from general funds to be kept separate from the funds it uses for general operations. Perhaps the most disturbing facet of this is that there are no conditions placed on the pensions that will fix the underlying problem.

The legislation requires the troubled plans to keep their grant money in investment-grade bonds, and bars them from commingling it with their other resources. But beyond that, the bill would not change the funds’ investment strategies, which are widely seen as a cause of their trouble.

A proposal for structural reforms failed:

On Friday, Senator Chuck Grassley, Republican of Iowa, introduced his own legislative proposal for the failing pension plans, which he said would bring structural reforms to make them solvent over the long term. He called the measure put forth by Democrats “a blank check” and tried to have it sent back to the Senate Finance Committee for retooling.

“Not only is their plan totally unrelated to the pandemic, but it also does nothing to address the root cause of the problem,” Mr. Grassley said in a statement. His motion failed in a vote of 49 to 50.

To illustrate how large this segment of the funds provided for is, Senator Bill Haggerty (R-Tenn.) said: “Just to show you how bad this bill is, there’s more money in this to bail out union pension funds than all the money combined for vaccine distribution and testing,”

Democrats are trying to say the pandemic made the pension shortfalls worse, but that would seem to be an overstatement because stock market performance has not suffered dramatically during that time. The 10-year inflation-adjusted return for 2020 was 11.96%. The S&P 500 increased 16% in 2020 alone.

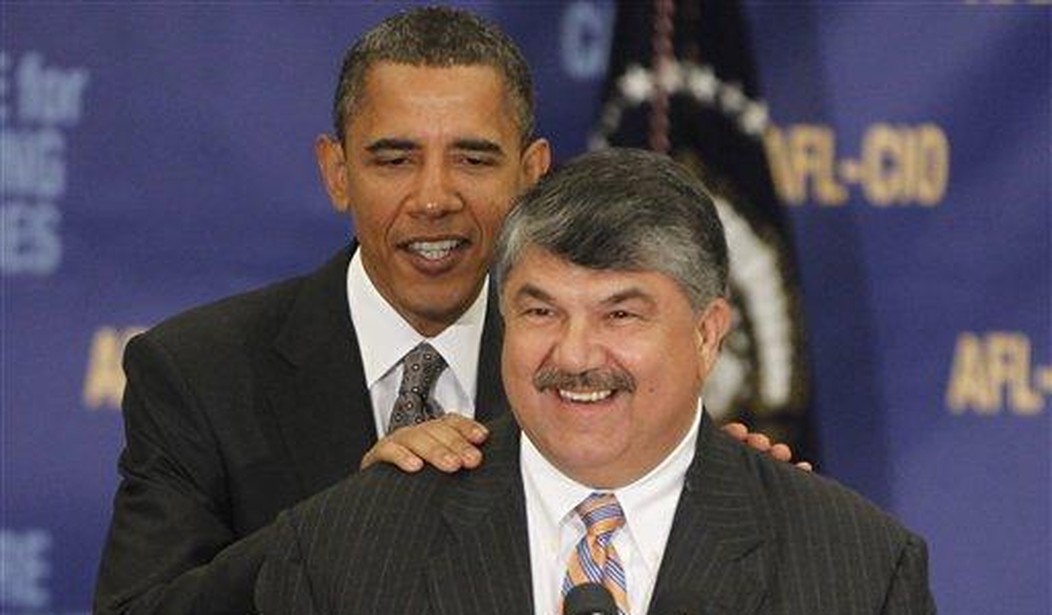

This bailout appears to be just another giveback long in the making. According to Time magazine, the coordinated plan to influence to 2020 election originated in the national office of the AFL-CIO. Multi-employer unions, such as the Teamsters and United Autoworkers, are powerful constituencies for the union leadership. One huge Teamster plan that expected to go broke in 2025 just got rescued. AFL-CIO President Richard Trumka now has a material win to offset the devastation that has already started and will likely continue in the energy industry.

Taxpayer funding of pensions was unheard of up to this point. Even those who have saved appropriately in defined contribution plans like 401(k)s will also fund their fellow citizens’ pensions through their tax dollars. This taxpayer bailout may be the first time, but given that the bill requires almost no reforms, it increases the likelihood it will not be the last.

Join the conversation as a VIP Member