WASHINGTON – In the midst of a potential $85 billion AT&T-Time Warner merger, House Democrats have introduced legislation that would establish a new commission charged with investigating corporate mergers and market concentration.

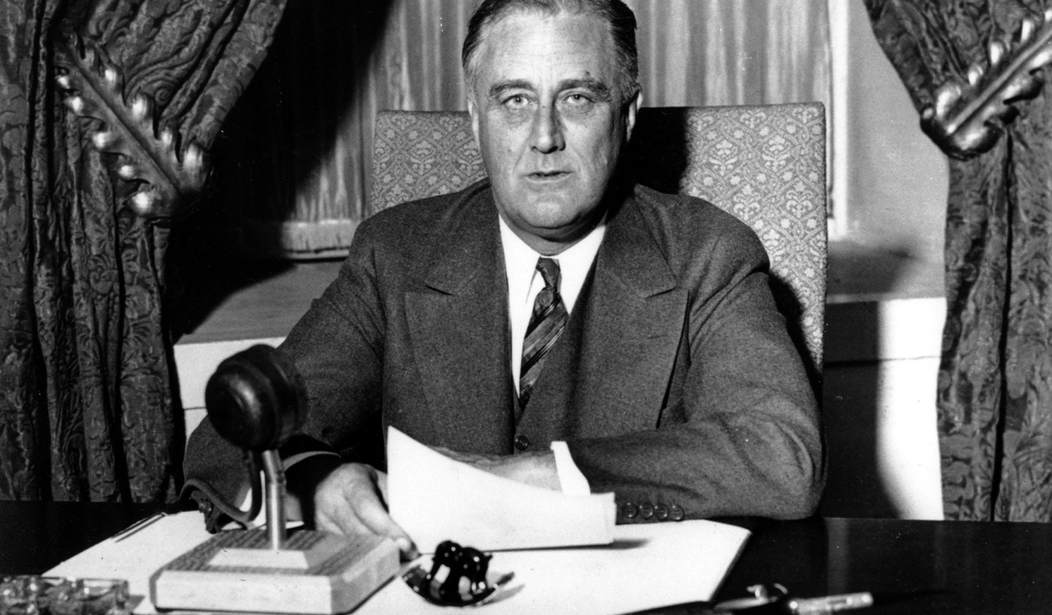

According to an announcement Wednesday from the lawmakers, the National Commission on Economic Concentration would be modeled after President Franklin D. Roosevelt’s Temporary National Economic Committee, which investigated monopolies during World War II.

The Department of Justice in November sued to block the $85 billion AT&T-Time Warner merger, which would combine the world’s largest telecommunications company, AT&T, with the third-largest entertainment company.

Democrats on the House Judiciary Committee have accused President Trump of improperly attempting to block the merger, as the president has repeatedly bashed Time Warner-owned CNN as “fake news.”

A separate group of Democrats is now backing the 21st Century Competition Commission Act, which would establish the new body. Introduced by Rep. Keith Ellison (D-Minn.), the legislation has the support of Reps. Pramila Jayapal (D-Wash.), Mark Pocan (D-Wisc.) and David N. Cicilline (D-R.I.). Cicilline was also involved with the Judiciary group accusing Trump of injecting himself into the AT&T-Time Warner merger.

“Monopolistic corporations have grown so big and powerful that they have hijacked our democratic process and our daily lives, leading us to a new Gilded Age,” Ellison said in a statement. “This sweeping bill aims to analyze all the ways monopolization has made our economy worse for working families, and help our government use existing antitrust laws to fix it.”

In the same announcement, the Open Markets Institute’s Lina Khan compared the new commission to the Pujo and Pecora hearings, which “helped expose the extremity of America’s concentration problem” in the early 20th century.

Established in 1912, the Pujo Committee investigated a group of Wall Street bankers, predominantly tied to Morgan and Rockefeller, who controlled an estimated $22 billion in funds and assets. The committee’s findings led to ratification of the Sixteenth Amendment, authorizing a federal income tax and implementation of the Federal Reserve and Clayton Antitrust acts.

The Pecora Committee was established during the Great Depression to investigate banking practices. The investigation featured testimony from high-profile bankers, which gained the attention of Americans who had lost their savings in the 1929 market crash. The probe led to passage of the Glass-Steagall Act, which restructured the banking system, and the establishment of the Federal Bank Deposit Insurance Corporation.

Ryan Bourne, an economist at the Cato Institute, said in an interview this week that Democrats are wrongly focusing on market concentration. He argued that the U.S. is better off with open, competitive markets than it is with regulators playing “whack-a-mole.” The focus should be consumer welfare, not what impact one company has on the other, he said.

“Implying that the whole economic system is dominated by these captured markets, where firms are ripping off consumers left, right and center, I think, is a huge mischaracterization,” he said, adding that allowing the government to break up markets in this way introduces a political dynamic. “Politicizing anti-trust law in this way … can have dangerous consequences in terms of politicians getting directly involved in certain mergers and anti-trust cases.”

There is no doubt, he added, that in certain markets there is the appearance of monopolistic or oligopolistic practices, where regulation could enhance consumer welfare. That includes internet, television and mass media providers. At the same time, he said, adding regulations creates new barriers for entry, effectively reducing competition.

Judging competitiveness of the market purely on market concentration leads to situations where it seems action is needed when a firm only has dominance over a market because they’re providing a product that adds real value to consumers, he said.

Jayapal in her own statement said that robust anti-trust laws help protect wages and improve consumer services at competitive prices.

“If Republicans are serious about protecting Main Street, not Wall Street, they will join us in passing this bill to simply assess the scope of America’s market concentration problem,” Jayapal said.

The legislation has not garnered support from any Republican co-sponsors.

Join the conversation as a VIP Member