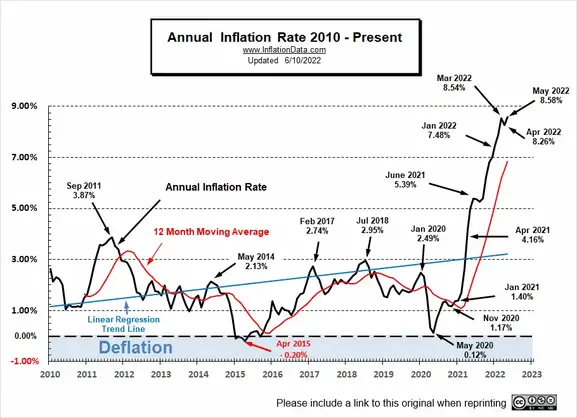

The U.S. government announced Friday that May’s federal inflation numbers increased to a crippling 8.58%. According to the official Bureau of Labor Statistics (BLS) news release:

The increase was broad-based, with the indexes for shelter, gasoline, and food being the largest contributors. After declining in April, the energy index rose 3.9 percent over the month with the gasoline index rising 4.1 percent and the other major component indexes also increasing. The food index rose 1.2 percent in May as the food at home index increased 1.4 percent.

The index for all items less food and energy rose 0.6 percent in May, the same increase as in April. While almost all major components increased over the month, the largest contributors were the indexes for shelter, airline fares, used cars and trucks, and new vehicles. The indexes for medical care, household furnishings and operations, recreation, and apparel also increased in May.

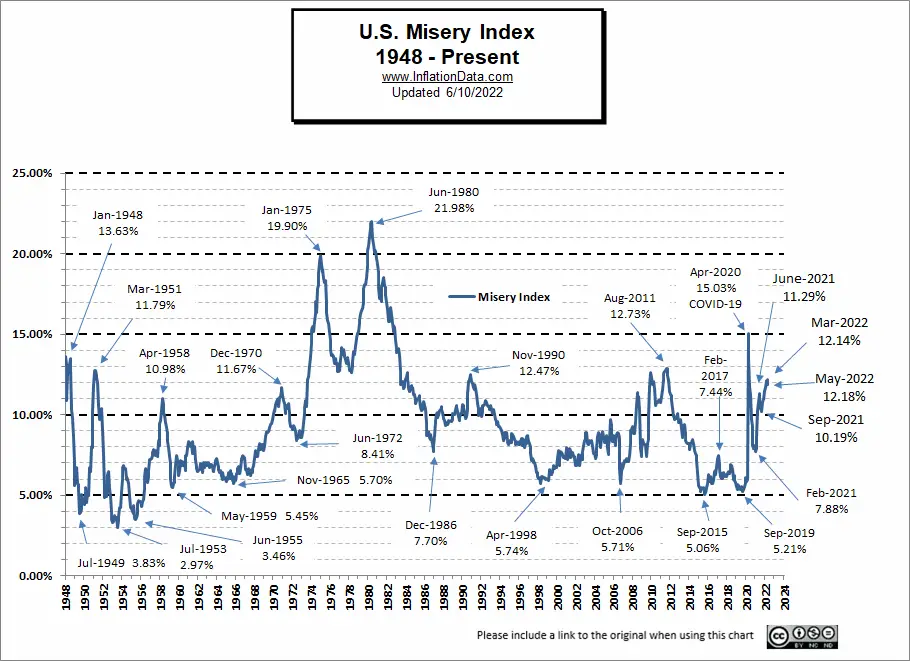

From this BLS data, economists are able to quantify the economic health of the country. They add the most recent U.S. unemployment rate, which is 3.6%, to the current rate of U.S. inflation, which is 8.58%, to produce a snapshot of the country’s economy. The result is known as the U.S. Misery Index.

The current U.S. Misery Index stands at a very miserable 12.18%.

With inflation at record-high levels not seen since the Jimmy Carter administration, it’s unsurprising the Misery Index climbed ever higher over last month’s levels, causing increases in basic necessities like food, shelter, and gasoline. In other words, American consumers are now feeling Bidenflation in their wallets every single day.

So what exactly does the Misery Index tell us? First, we know that as the rate of inflation goes up, the cost of living increases. Next, as the unemployment numbers rise, more and more people fall into poverty. Consequently, the Misery Index acts as a kind of snapshot of time to gauge the health of the economy as a whole, since both unemployment and inflation significantly impact the average American wage earner’s spending power.

Recommended: The State of Logistics in a Supply Chain Crisis and Struggling Economy

And, while not perfect, the Misery Index is useful to gauge how the ups and downs of the U.S. economy under the Biden-Harris administration’s ruinous economic policies are impacting average Americans. As the feckless Biden Administration continues to gaslight, spin and deflect blame for the soaring cost of living in the United States, most Americans are forced to tighten their belts by cutting back on everyday expenses like groceries, gasoline, and housing.

As Bideninflation climbs into the Carter-level stratosphere and the feds raise interest rates, falling consumer sentiment is the next casualty adding to American misery. “[The U.S. Consumer Sentiment] has never been lower than it is today,” tweeted Founder and CEO of Compound Capital Advisors Charlie Bilello on Friday.

The US consumer sentiment index from the University of Michigan goes back to 1952.

It has never been lower than it is today.

Charting via @ycharts pic.twitter.com/etlGSTDWTy

— Charlie Bilello (@charliebilello) June 10, 2022

Simply put, inflation decreases the purchasing power of consumers. Higher prices mean that consumers can purchase fewer goods, so even as Americans return to work after the economic disruptions of the pandemic, their wages, savings, and investments buy less and less as inflation rises higher and higher. Add the recent higher mortgage rates to the mix, and many American families are now priced out of the housing market. And let’s not forget gasoline prices, which rose to historically high averages on Saturday.

Gas prices in the US crossed above $5.00/gallon today for the first time in history. pic.twitter.com/OvZ2BePcgl

— Charlie Bilello (@charliebilello) June 11, 2022

It’s also worth noting that we saw these record-high inflation levels in the early 1980s at the end of Carter’s economically disastrous administration, but right now, we’re not even two full years into the Biden-Harris nightmare administration. As my fellow GenXers know, the 1980s, while being a totally awesome time to grow up, in other respects was simultaneously a totally bogus time for our parents’ wages and wallets. Buckle up, my friends, the next few years could get totally gnarly.

Join the conversation as a VIP Member