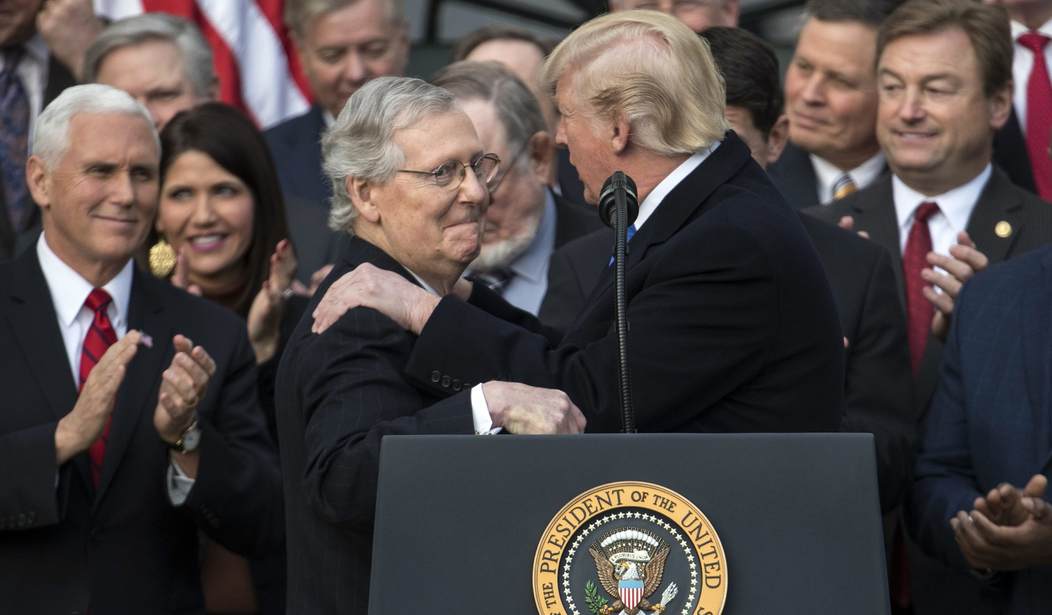

WASHINGTON — President Trump celebrated the passage of tax reform legislation on the South Lawn today with congressional Republicans, but hasn’t yet signed the bill.

If he signs it this month, explains CBS, deep spending cuts to a number of programs such as Medicare would take effect in January, as Republicans head into the midterm election season. If the president signs the bill in January, the cuts wouldn’t be triggered until 2019.

The U.S. Conference of Catholic Bishops, which in November urged lawmakers to correct “many fundamental structural flaws” before passing the bill, today called on Trump to hold off signing the legislation to “take into account the full consequences of its provisions and work with Congress to remedy them before signing a tax bill into law.”

“The legislation achieves some laudable things, like doubling the standard deduction, which will help many struggling families avoid tax liability, expanding the use of 529 education plans, and increasing the child tax credit,” Bishop Frank J. Dewane of Venice, Fla., chairman of the U.S. Conference of Catholic Bishops’ Committee on Domestic Justice and Human Development, said in a statement.

“However, the Act contains a number of problematic provisions that will have dramatic negative consequences, particularly for those most in need,” Dewane said. “Among other things, the Joint Committee on Taxation indicates that the bill will eventually raise taxes on those with lower incomes while simultaneously cutting taxes for the wealthy. This is clearly problematic, especially for the poor. The repeal of the personal exemption will cause larger families, including many in the middle class, to be financially worse off.”

The bishop also noted that the final bill “creates a large deficit that, as early as next year, will be used as a basis to cut programs that help the poor and vulnerable toward stability.”

“The legislation is also likely to produce up to a $13 billion drop in annual charitable giving to nonprofits that are relied upon to help those struggling on the margins,” Dewane added. “This will also significantly diminish the role of civil society in promoting the common good.”

After an analysis of the House and Senate bills prior to reconciliation, the bishop told lawmakers in a Dec. 6 letter that “policy that is good for workers, families who welcome life, families who are struggling to reach (or stay in) the middle class, and the very poor, has by design been a part of our tax code for years,” and “any modifications to these important priorities of our nation should only be made with a clear understanding and concern for the people who may least be able to bear the negative consequences of new policy.”

Archbishop of Washington Cardinal Donald Wuerl told Fox News today that “we have to wait and see what exactly is in this legislation” that was quickly pushed through Congress.

“I think we would all applaud any part of the cut that focuses on people who have the greatest needs. And that’s where we want to take the focus, people who have enormous needs, working people, people who are raising children, people who have their kids in schools and need to be able to get some support for that,” Wuerl said. “Those are the people you want to see get a break. And I’m hoping that that’s what’s going to be in this package when we finally get to be able to understand what is in it… There should be an equitable distribution of the burden for everyone, so that everyone gets a fair share of the burden and a fair share of the benefit.”

Join the conversation as a VIP Member