In September 2008 (“Think Enron Was Bad? ‘Fredron’ and ‘Fanron’ May Be Worse”), reacting to the implosions at Fannie Mae and Freddie Mac, the two “government-sponsored enterprises” that had just become “government-controlled enterprises,” I quoted a Wall Street Journal editorial telling readers that “taxpayers are now on the hook for as much as $200 billion.”

We should be so lucky. On New Year’s Eve, a Bloomberg story headline told us that the losses will be $400 billion. The story’s first sentence actually says that “taxpayer losses from supporting Fannie Mae and Freddie Mac will top $400 billion” (italics mine). The only question appears to be: “By how much?” We’re already at eight Enrons (losses there were roughly $50 billion) and counting.

The government has given up even trying to guess how deep the hole is. On Christmas Eve, the Treasury Department, which had previously “limited” its financial commitment to $400 billion ($200 billion for each entity), issued a cleverly worded press release. Blandly titled “Update on Status of Support for Housing Programs,” it tells us that Treasury’s financial commitment to keep the two entities afloat will “increase as necessary to accommodate any cumulative reduction in net worth over the next three years.” In other words, Fan and Fred will receive relief without limits.

Many readers will be less than pleased to know that Massachusetts Congressman Barney Frank now considers Fan and Fred to be a “public policy instrument” of the government, and that they “have become a kind of public utility.” In her story about the unlimited relief with a Pollyanna title (“New Aid for Fannie and Freddie”), Louise Story at the New York Times writes that “the Obama administration has effectively transformed them into arms of the government, using them to help carry out its mortgage modification programs.” Great.

How have these new “arms of the government” been performing? Last week, Peter S. Goodman at the Times brought forth evidence that the modification programs have “done more harm than good.” That harm is escalating. Desperate for success stories, Treasury reacted to the fact that many of those who are trying to get relief are fudging their applications by significantly understating their income in hopes of getting undeservedly low monthly payments by issuing a mid-December directive ordering participating lenders not to penalize applicants for having done so. Associated Press columnist Rachel Beck describes this move as “reward[ing] liars.” Expect more liars to apply for “rewards.”

This is all happening way too easily. It’s enough to make you wonder if designing Fan and Fred for failure while making them “too big to shrink” in the eyes of many hasn’t been the plan all along.

If the previous statement seems extreme, consider this shocking revelation carried in the Wall Street Journal last week — a tidbit that also, strangely enough, has barely gotten any notice in the rest of the establishment media:

New research by Edward Pinto, a former chief credit officer for Fannie Mae and a housing expert, has found that from the time Fannie and Freddie began buying risky loans as early as 1993, they routinely misrepresented the mortgages they were acquiring, reporting them as prime when they had characteristics that made them clearly subprime or Alt-A.

Before Pinto’s bombshell, we knew that Fan and Fred were used as instruments to “encourage” loans to undeserving borrowers. We knew that this “encouragement” was enforced through the Community Reinvestment Act (CRA), a law originally passed in the 1970s that was “progressively” given threatening teeth in ensuing years.

We have known for some time, as described in my September 2008 column, that Fan and Fred lowered the qualifying standards for conventional and subprime loans they would buy from participating lenders roughly as follows (quoting from that column):

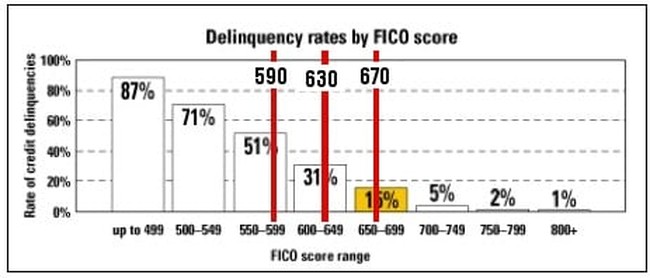

The credit score threshold for conventional mortgages, which had generally been 670 or more, dropped to about 630. In the real world, a score of 630 indicates that you’re having trouble with your debt load, paying your bills on time, or a little of both.

More ominously, the credit score threshold for subprime mortgages, which had generally been 630 or more, fell to about 590. A score of 590 is the credit scoring equivalent of barely having a pulse.

We know that in doing this, Fan and Fred, as well as those who underwrote or bought securities backed by these conventional and subprime mortgages, were taking a huge risk by hoping that borrowers with mediocre or poor credit histories would somehow keep up with their mortgage payments. The chart from Fair Isaac, which shows the chances of going seriously delinquent (90 days or more late) for various credit score ranges based on lenders’ experience through the mid-2000s, shows how serious that risk assumption was:

In lowering the conventional score threshold, Fan and Fred hoped that borrowers with scores between 630 and 670 would defy all reasonable expectations that they would fall seriously behind on their mortgages at three or more times the rate of those whose scores exceeded 670. In lowering the subprime score threshold, they dreamed that the default rates would be far below the experience-based average of about one-third. They passed these hopes and dreams on to both their stockholders and those who invested in mortgage-backed securities. These judgments have proven horribly wrong.

Incredibly, the Pinto paragraph above takes things one step further. It’s bad enough that Fan and Fred lowered the loan approval thresholds. Pinto’s point is that for 15 years, they doubled down by “routinely” misclassifying approved loans, effectively telling the capital markets and the public that these loans weren’t as risky as they really were. Because of this, securities backed by these mortgages carried lower interest rates than they would have if the risks had been properly disclosed. Some of the offerings should probably never have been issued or should have been given junk bond pricing. Further, misrepresented loans Fan and Fred kept on their books enabled the two entities to continually make false claims of financial health.

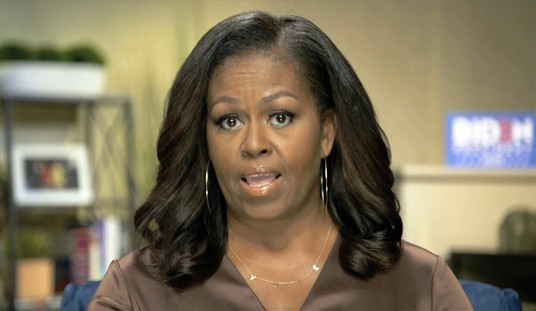

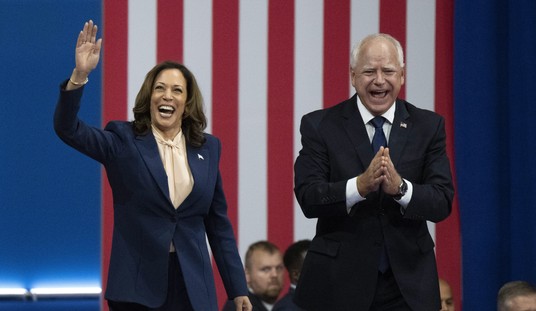

Enron’s perpetrators were aggressively prosecuted and shamed, while Fannie Mae’s and Freddie Mac’s executives, officers, and directors made and kept millions in undeserved salaries and bonuses, even during years-long periods when their books were unauditable. Up to and including Rahm Emanuel, President Obama’s chief of staff, many if not most of them are still influential and respected players within the government and the Democratic Party.

Meanwhile, the government has gained a firm and seemingly indefinite grip on goings-on in the housing and mortgage markets. We’re supposed to believe that this statist result is merely the product of extraordinary incompetence and greed with no grander design. Excuse me for being skeptical.

Join the conversation as a VIP Member