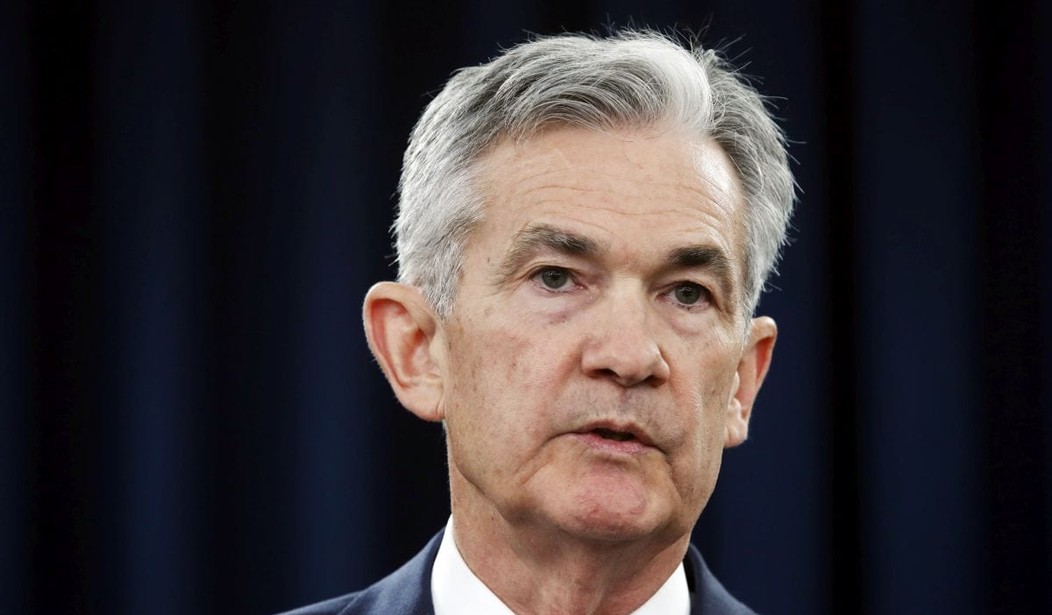

Presidentish Joe Biden on Monday nominated inflation dove Jerome Powell to a second term as chairman of the Federal Reserve after a year in which inflation became Americans’ top concern.

In a statement, the White House says that during Biden’s first year in office, Powell “oversaw a landmark re-evaluation of the Federal Reserve’s objectives to refocus its mission on the needs of workers of all backgrounds.”

However, CNBC reported earlier this month that “inflation has taken away all the wage gains for workers and then some.”

“Real average hourly earnings,” wrote Jeff Cox, “when accounting for inflation, actually decreased 0.5% for the month. A 0.9% inflation increase negated a 0.4% rise in wages.”

Inflation hits hardest those who can afford it least.

If that’s the Fed successfully looking after the “needs of workers of all background,” I’d hate to see what happens when Powell slips up.

The Wall Street Journal reported Monday morning that Powell is “arguably the most dovish chairman in the Federal Reserve’s modern history.”

Powell, WSJ’s Greg Ip argues, may have to make a “painful” pivot away from stimulating the economy to “giving priority to inflation at the risk of sacrificing jobs.”

However, I’m not sure how likely that is. Inflation, which effectively wipes out debt, is much more in line with Washington’s interests than the high interest rates needed to combat inflation.

Recommended: Bidenflation: It’s Official, You’re Worse Off Than You Were Just Ten Months Ago

If inflation stays high, Washington’s debt problem is eased. If interest rates go up, so does the service Washington must pay on its existing $29 trillion debt.

Also today, Biden nominated Dr. Lael Brainard to serve as vice-chair of the Board of Governors of the Federal Reserve System. Brainard is known as “one of the Fed’s most outspoken climate change critics,” according to Forbes.

Brainard is much more dovish than Powell, meaning she’s generally more willing to keep monetary policy accommodative—through low interest rates and quantitative easing, for example — in order to stimulate more economic activity.

Brainard is also a critic of “wealth inequality,” another position usually indicative of someone who favors loose monetary policy, even as inflation eats away at middle-class household budgets.

Hang on to your wallets, folks — it looks like we’re not getting off this bumpy ride any time soon.

Join the conversation as a VIP Member