An amusing story out of Sacramento today as the California Senate approved a plan to provide a single-payer health care system for the state.

What’s funny about it is that the plan costs $400 billion and not one single advocate of the program has told citizens how they are going to pay for it.

And how can they? Single-payer health insurance will cost twice the state’s budget total for 2018.

The bill “would bring the dream of guaranteeing healthcare to all Californians–without the devastating out-of-pocket costs that force millions to skip needed care even if they are already paying premiums to insurance companies,” the California Nurses Association, a key supporter, said.

But supporters and lawmakers involved acknowledge they don’t have a consensus on how to pay for what will cost $400 billion.

One widely cited says the California single payer system “could produce savings of about 18%” for state residents. It suggests a mix of taxes be used to pay for it.

“The proposed single-payer system could provide decent healthcare for all California residents while still reducing net overall costs by about 8% relative to the existing system,” researchers from University of Massachusetts-Amherst Department of Economics and Political Economy Research Institute said in a report last month. “We propose two new taxes to generate the revenue required to offset the loss of private insurance spending: a gross receipts tax of 2.3% and a sales tax of 2.3%, along with exemptions and tax credits for small business owners and low-income families to promote tax-burden equity.”

But opponents, generally Republicans, say many will get hit with a higher tax bill if the legislature follows through with a financing package.

Even some Democrats aren’t sure about financing this gargantuan program.

Some Democrats felt the bill was rushed and undeveloped. Sen. Ben Hueso (D-San Diego) withheld his vote on the bill on grounds it does not provide enough detail of what a single-payer system would look like.

“This is the Senate kicking the can down the road to the Assembly and asking the Assembly to fill in all of the blanks,” Hueso said. “That’s not going to happen this year.”

Lara said action is required because of what is happening in Washington.

“With President Trump’s promise to abandon the Affordable Care Act as we know it — for one that leaves millions without access to care — California is once again tasked to lead,” he told his colleagues.

He said his father recently had heart bypass surgery but went through the emergency room for help after his insurance company initially turned him down.

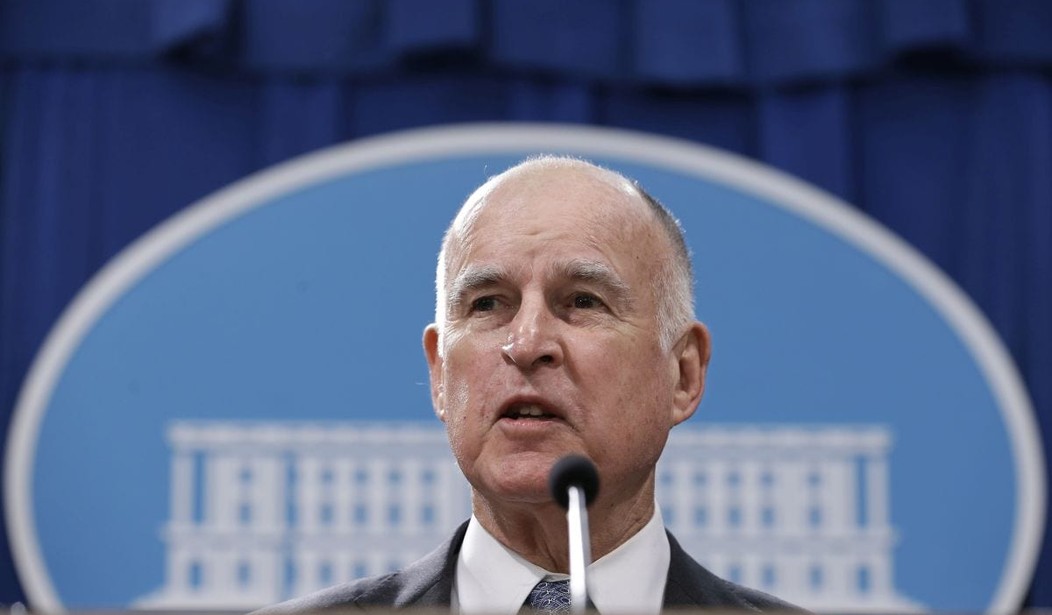

Even if the bill is approved, it has to go to Gov. Jerry Brown, who has been skeptical, and then voters would have to exempt it from spending limits and budget formulas in the state Constitution. In addition, the state would have to get federal approval to repurpose existing funds for Medicare and Medicaid.

The $107 billion in tax increases are only the start. As we all know from seeing other states massively increasing taxes, the amount that’s collected is always far less than what was projected.

And there is no guarantee that Washington will allow the state to “repurpose” (steal) Medicare and Medicaid funds to pay for this white elephant.

Since Governor Jerry Brown’s proposed 2018 budget totals only $177 billion, it remains to be seen how they are going to come up with the $400 billion to pay for it all.

More than likely, they won’t.

Join the conversation as a VIP Member