This report in Spiegel Online about Europe’s faltering carbon trading market indicates a possible shift in opinion in Europe on climate change and what, if anything, to do about it.

For those involved in European Union climate policy, the German regional election in Lower Saxony on Sunday was a nail-biter. The hope for many was that Germany’s pro-business Free Democratic Party (FDP) would suffer defeat and leader Philipp Rösler, who has been under pressure within his party for weeks now, would be forced to step down as economics minister. But that didn’t happen. Instead, Rösler ended up in a stronger position than before, and the flagship project of Europe’s climate policy settled deeper into a lifeless coma.

Rösler is against a short-term plan to boost prices on the European Emissions Trading System (ETS), while Environment Minister Peter Altmaier of Chancellor Angela Merkel’s conservative Christian Democratic Union (CDU) party favors it. Rösler opposes any intervention in the carbon market and stands by the market process that has resulted in a collapse in the price of carbon allowances. The plan, called backloading, would take 900 million carbon allowances out of the system temporarily to help boost the carbon prices and partially relieve a massive glut. But the German government is split on the plan, with Merkel remaining on the sidelines. Whatever happens, market players say it is already clear that Germany’s stance will be pivotal.

“I have been surprised about how unwilling Angela Merkel has been to step into this debate and resolve it on behalf of the government,” said Mark Lewis, a climate market analyst at Deutsche Bank. “It’s extremely frustrating. It’s taking longer and longer. And as a result, the market is going lower and lower.”

The German Chancellery did not respond to a request for comment.

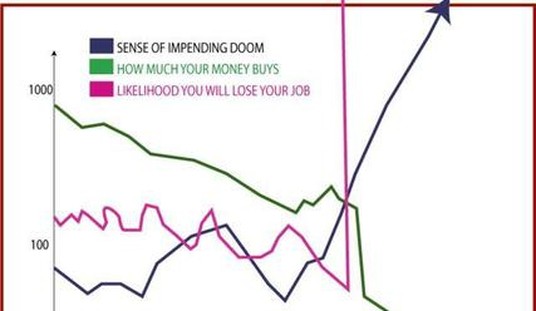

The ETS is now in its crucial third phase — one in which it was to reduce the number of carbon credits available on the market, forcing prices up and pollution down. However, too many carbon credits were issued in the early years and companies produced less in the downturn, resulting in a surplus of credits. Prices have gotten so low that Germany recently cancelled an auction of carbon credits for the first time, after no bids came in at the minimum price.

This makes one think that the carbon “market” isn’t much of a market at all. Artificially created with no idea of the intrinsic value of “credits,” of course it’s dysfunctional. Trying to create demand for credits isn’t going to work any better, especially when you consider that any “value” is dependent on governments propping up the price.

When you have the EU climate commissioner begging governments to “act responsibly,” you know the carbon market may be nearing the end of the line:

“This should be the final wake-up call,” said EU Climate Commissioner Connie Hedegaard, according to wire reports. “Something has to be done urgently. I can therefore only appeal to the governments and the European Parliament to act responsibly.”

On Thursday, the price hit a low of €2.81 ($3.75) per metric ton of carbon and rebounded back above €4 before the end of the day. But it remains far below the €20 or €30 price point that analysts say is needed to spur the type of clean investment needed by industry to cut carbon emissions.

The entire scheme reminds us of one of the major rules of markets: The intrinsic value of anything is worth only what someone else will pay for it.

Join the conversation as a VIP Member