Theranos founder and CEO Elizabeth Holmes has been accused of “massive fraud” by the U.S. Securities and Exchange Commission (SEC), it was announced on Wednesday. Holmes was a Silicon Valley entrepreneur who promised to revolutionize medical testing. She claimed to have developed a product that would change the way blood testing was done and do it for much less. Her product, called Edison, was a small portable device that could run 240 blood tests using just a few drops of blood.

The company was one of the most visible and promising Silicon Valley startups in recent years, raising hundreds of millions of dollars and assembling a prestigious board of directors. Holmes fit the image perfectly: she was a 19-year old college dropout on a mission to help the world, and one of the youngest female CEOs ever. She claimed she was inspired to create her product because she hated needles as a child. She dressed like Steve Jobs, wearing a black turtleneck sweater at most of her public appearances.

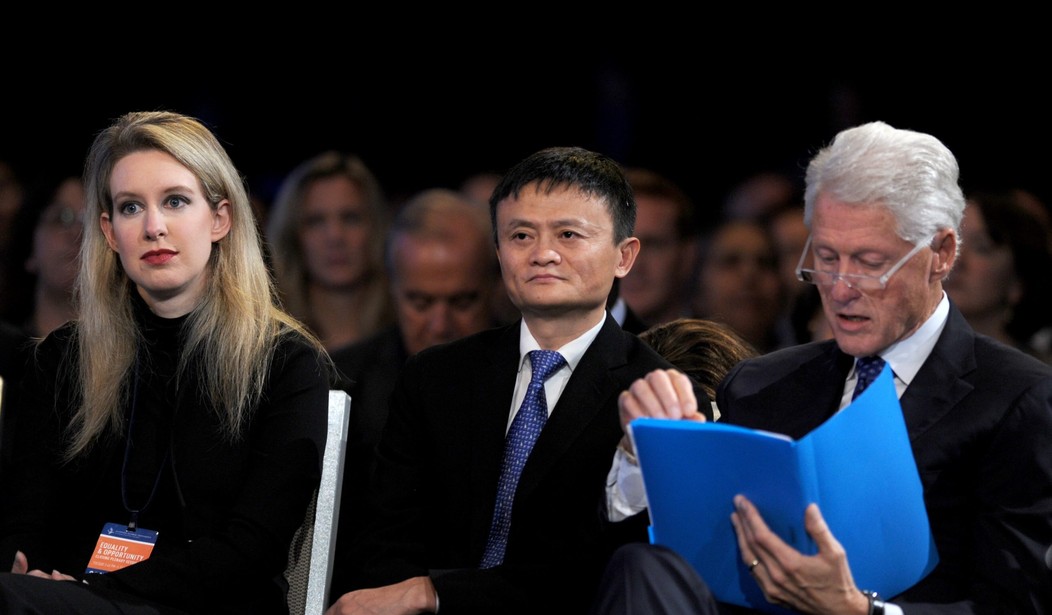

Holmes was able to attract supporters that included former Secretaries of State George Shultz and Henry Kissinger, former Secretary of Defense William Perry, former Senators Sam Nunn and Bill Frist, current Secretary of Defense James Mattis, Bill and Hillary Clinton, and famed attorney David Boies, among others. And money flowed in… well… like blood. She was able to raise more than $750 million, valuing the company at $9 billion.

But there was just one problem. No one was ever able to see Edison actually work. Not the board, not the investors, and not even Walgreens, which nevertheless invested $50 million sight unseen. That’s because Edison never did work.

While press coverage was mostly fawning, Wall Street Journal reporter John Carreyrou was skeptical and began to investigate the company. He wrote a series of articles beginning on October 16, 2015, in which he expressed doubts about the company’s claims.

Holmes reacted with indignation, calling the story “factually and scientifically erroneous and based on accusations by disgruntled former employees.”

She said, “Stories like this come along when you threaten to change things, seeded by entrenched interests that will do anything to prevent change, but in the end, nothing will deter us from making our tests the best and of the highest integrity for the people we serve, and continuing to fight for transformative change in health care.”

Holmes took her indignation to Jim Cramer’s “Mad Money” show on CNBC, sounding like Steve Jobs: “This is what happens when you work to change things. First, they think you’re crazy, then they fight you, and then, all of a sudden, you change the world.“

Holmes was masterful in her ability to convince most everyone that she was doing what she said, yet no one ever got a close look at the product. She lied about revenue, about how many tests they had conducted, and how about how successful they were. And, most seriously, the company put patients at risk, conducting blood tests whose results were bogus.

She was a complete fraud, yet she managed to convince her investors, board, and most of the reporters that she was changing the world. But her story continued to unravel with each successive story Carreyrou wrote.

U.S. Defense Secretary James Mattis has declined to comment on the $700 million fraud, much of which occurred while he sat on the company’s board of directors. And while this was all unraveling, the Hilary Clinton campaign held a fundraiser with Holmes, apparently oblivious to what was unfolding.

Holmes and Theranos have reached a settlement agreement with the SED. “Theranos Inc. announced today that the company and its CEO, Elizabeth Holmes, have resolved a previously disclosed investigation by the U.S. Securities and Exchange Commission (SEC) into the offer and sale of Theranos securities from 2013 to 2015,” Theranos said in a statement Wednesday.

Holmes will pay a $500,000 fine as a result of the settlement and must return her $18.9 million shares of stock. Neither Holmes nor Theranos has admitted any wrongdoing.

The mild settlement does not address whether federal prosecutors will file criminal charges. The company has been under scrutiny by U.S. prosecutors in San Francisco, but a spokesman for the U.S. Attorney’s Office in the city has not commented. There’s more to come, including a book and movie based on Carreyrou’s reporting.

Join the conversation as a VIP Member