On Wednesday, during his speech before a joint session of Congress, President Joe Biden called his big-government boondoggles “fiscally responsible” because he has a plan to pay for them: taxing the wealthy. His unrealistic tax plan doesn’t come close to footing the bill — but it will damage the U.S. economy overall, according to Heritage Foundation analysts.

“President Biden’s massive tax hikes would harm the American people. When taxes go up, wages go down, costs go up, and the number of people working goes down. Now, as the economy is just beginning to recover, is the worst time to be increasing the tax burden on small businesses,” Matt Dickerson, director of the Grover M. Hermann Center for the Federal Budget, told PJ Media.

Biden did not flesh out his tax plan in vivid detail, but he did present broad strokes.

Recommended: INFLATION: Reality Sets in Amid Biden’s Incomprehensible Spending Sprees

“I will not impose any tax increases on people making less than $400,000 a year,” he promised. “It’s time for corporate America and the wealthiest 1 percent of Americans to pay their fair share, just their fair share.”

Biden claimed that 55 of America’s largest corporations — which made more than $40 billion in profits — paid zero in federal income tax in 2020. He mentioned tax havens like the Cayman Islands, tax loopholes, and tax deductions, promising to rein in these tax-evasion efforts.

“We take the top tax bracket for the wealthiest 1 percent of Americans – those making $400,000 or more – back up to 39.6 percent,” he added. “We’re going to get rid of the loopholes that allow Americans who make more than $1 million a year pay a lower rate on their capital gains than working Americans pay on their work. This will only affect three-tenths of 1% of all Americans.”

“And the IRS will crack down on millionaires and billionaires who cheat on their taxes,” the president said.

“That’s estimated to be billions of dollars,” Biden insisted.

Yet in the same speech, the president celebrated a $1.9 trillion COVID-19 “relief” package and urged Congress to pass a $2.25 trillion “infrastructure” bill and a $1.8 trillion American Families Plan. Even if Biden’s tax schemes would raise “billions,” that wouldn’t come close to the $5.95 trillion that those bills alone cost, not to mention any other items on Biden’s agenda.

Worse, Biden’s tax plan would cause tremendous economic damage — damage that would trickle down to workers, consumers, and the economy as a whole.

“High-income earners and corporate executives will respond to higher U.S. taxes by earning and producing less in the U.S., thus erasing much of the supposed additional tax revenue from higher rates,” Joel Griffith, a Heritage research fellow, told PJ Media.

“Moreover, the tax increases now under consideration are just the start. In the absence of spending reform, taxes will have to increase much higher than is currently being proposed—and not just tax increases on the ‘rich,’” Griffith warned. “Just look to Europe, where funding big government requires high taxes on everyone. In fact, it is mathematically impossible to pay for significantly larger government with tax increases only on high-income earners and corporations.”

“That’s why a lower-income European earning $40,000 pays $6,000 more in taxes—an extra 15% of their income—than they would in America,” Griffith explained.

Democratic populists like Sen. Elizabeth Warren (D-Mass.) suggest that there is this massive horde of profits that rich people and corporations keep hidden away, and that if only the government could find it and tax it, America’s fiscal problems would disappear. Sadly, it’s not that simple. While corporations and individuals do indeed offshore some of their funds to avoid taxes, government attempts to tax that money often fail and produce negative economic consequences.

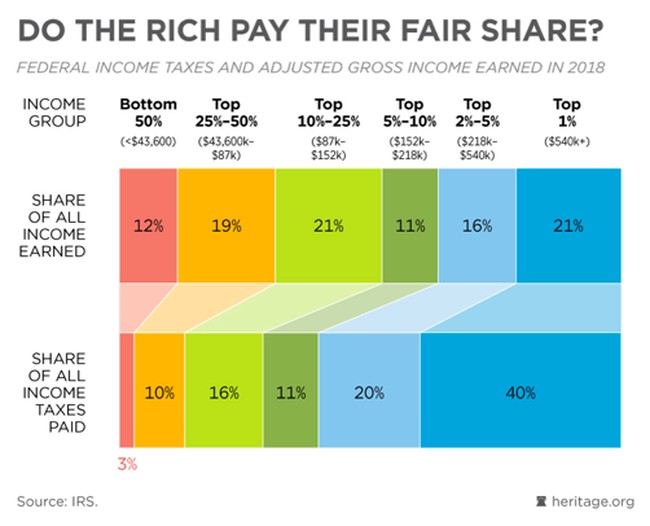

Furthermore, the rich already do pay a massive percentage of taxes.

Recommended: 5 Things to Know About Joe Biden’s Address to Congress

Biden’s plan to pay for supposedly wonderful social programs by merely closing loopholes and soaking the rich is pie-in-the-sky nonsense. These proposals won’t solve America’s dire fiscal crisis, but they will stifle the economic growth Biden bragged about, and hurt the very Americans Biden promises to protect.

Join the conversation as a VIP Member