The Coronavirus Aid, Relief, and Economic Security Act, also known as the CARES Act, was a $2.2 trillion economic stimulus bill passed in 2020. The act contained several programs, including direct payments to individuals and families of $1,500 per individual as well as the Payroll Protection Act, or PPP, that eventually totaled $800 billion and has been credited with saving “millions” of jobs.

In fact, the PPP did no such thing. And as the record shows, it actually cost America jobs in the long run.

The Republicans described the PPP as “a forgivable loan program designed to provide a direct incentive for small businesses to keep their workers on the payroll.” Instead, as a study done by the National Bureau of Economic Research (NBER) shows, most of the cash went into the pockets of business owners and investors.

A recent study of the program’s effects from the National Bureau of Economic Research (NBER) finds that the majority of the funds spent by the program went to business owners and shareholders rather than to workers themselves. Ultimately, “only 23 to 34 percent of the program’s funds went directly to workers who would have otherwise lost their jobs.” The jobs it did keep in place were preserved at very high cost—somewhere between $170,000 and $257,000 a year, far more than the typical earnings of affected workers, which are closer to $58,000 per year.

While the PPP was able to save some jobs, albeit, at a very high cost, the overall result of the program was precisely the opposite of what was intended. The purpose of the program was to preserve the jobs of wage workers, not to funnel money to business owners. As David Autor, a Massachusetts Institute of Technology economist and the lead researcher behind the paper, told The New York Times recently, “it turns out [the money] didn’t primarily go to workers who would have lost jobs. It went to business owners and their shareholders and their creditors.” The program, he added, was “highly regressive.”

Aside from the usual fraud, the PPP program was fatally flawed in determining who was eligible for the funds. Many large corporations gamed the system to receive loans they didn’t really qualify for.

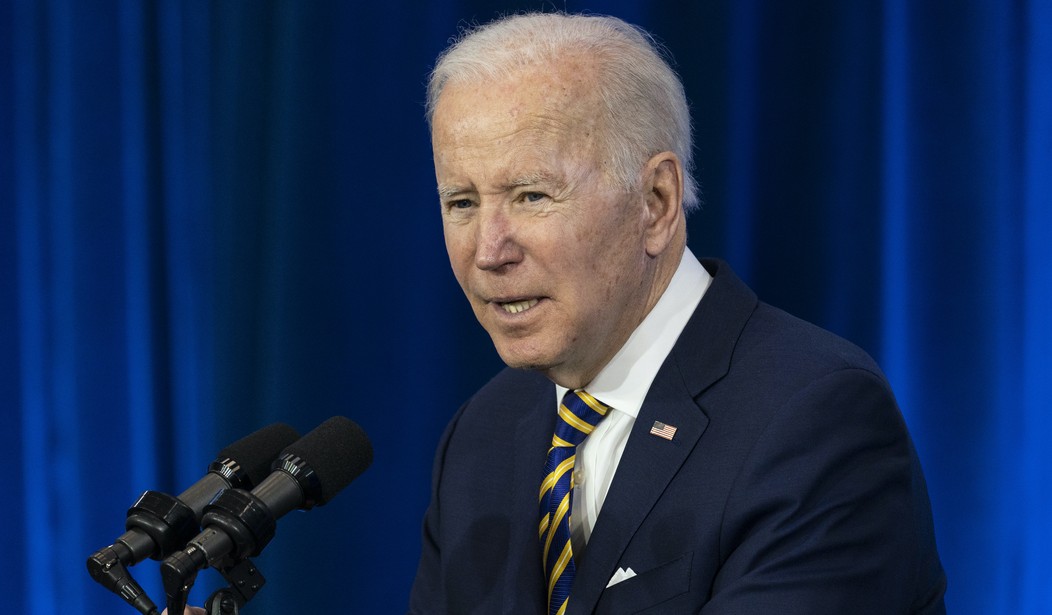

Related: Biden Looking to Spend $5 Billion on Charging Stations For Electric Cars

But this was an EMERGENCY! say proponents of the legislation. We would have loved writing the law more carefully but people were HURTING and they needed help NOW.

The authors suggest several reasons for the program’s unintended results. It was designed in haste at the beginning of the pandemic when many—including lawmakers and policymakers—believed that it would be a relatively short affair, and the economy would fully bounce back by summer. Initially, the PPP promised loan refundability to businesses that kept workers on their payrolls for eight weeks, essentially converting those loans into grants. But, as the pandemic dragged on and the program was topped up with additional funds, the requirements slipped, and the PPP eventually turned into something more like an all-purpose federally funded slush fund for small business owners.

The boondoggle extended to the pandemic unemployment compensation program — the costs of fraud are still being tabulated but are clearly in excess of $150 billion and may reach as high as $400 billion.

It doesn’t matter which party was responsible. The Republicans allowed this particular program to careen out of control. But Democrats have passed the $1 trillion infrastructure bill as well as the $1.9 trillion American Rescue Plan.

You can bet there will be plenty of waste and fraud in the administration of those bills, too.