A Wall Street Journal editorial calls the new Joe Biden tax legislation a “Washington money grab for the ages.” Indeed, what else do you call a $2.2 trillion government “snatch-and-grab” from successful Americans?

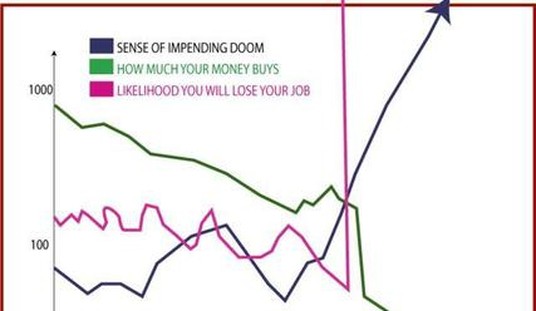

The Biden plan is full of all sorts of overly optimistic projections about how much money will be collected. It never quite works that way. Rich people, although not necessarily smarter than everyone else, tend to hire very smart accountants and tax lawyers — much smarter than government regulators and universally smarter than radical Democratic politicians.

Because of that, rich people’s wealth presents a constantly moving target that the IRS can never quite catch up to. The example often cited by opponents of any “tax the rich” scheme is the French “wealth tax” from the early 2010s. It was a massive failure largely because it was based on simple-minded assumptions of what wealth is and what it isn’t. It was so simple-minded that the radical socialists who dreamed it up never thought that thousands of rich people would simply pull up stakes and leave France in order to avoid the tax.

That’s what’s known as “voting with your feet.”

The salesmanship going into Biden’s tax bill has begun already. “Let’s stop pretending Biden’s proposed tax increases on the rich are radical,” intones a Washington Post editorial by reliable Biden shills Paul Waldman and Greg Sargent. “House Democrats’ Plan to Tax the Rich Leaves Vast Fortunes Unscathed,” claim Jonathan Weisman and Jim Tankersley of the New York Times — as if it’s OK to punish success because the radicals aren’t able to get at all of it.

The tax bill would be the largest increase since 1968. This alone makes the bill “radical” in the sense that it’s out of the mainstream of policymaking and politics. Let’s remind ourselves that these were the same people telling us the 2,100-page Affordable Care Act that overturned U.S. health care wasn’t “radical” either.

We should shudder when contemplating what these people consider “radical” to be.

So the tax bill would target only the very, very, filthy rich people in the country, right? Not hardly.

If Americans are successful, Democrats want to tax more of their income. The top individual tax rate will rise to 39.6% from 37%, as Mr. Biden promised. But wait: The higher tax rate will kick in at a mere $400,000 for individuals and $450,000 for married couples. That’s down from $523,600 and $628,300 under current law.

This is a steep rate increase on two-earner upper-middle-class families. They may reach these income levels after a long career, and only for a couple of years, but Democrats want more than 40% if you include the 1.45% Medicare payroll tax and the 3.8% ObamaCare surcharge on investment income.

Let’s not forget state taxes in that calculation of what the rich will owe.

If you make more than $5 million, there will also be a three-percentage-point income-tax surcharge. That would take the top tax rate to something like 46.4%. Add California or New York taxes, and government will take about 60%. Hilariously, the committee figures the surtax will raise $127 billion in revenue, as if the rich will be dumb enough not to find tax shelters.

How can any tax system that purports to be “fair” take 60 cents of every dollar earned by someone in a free country — wealthy or not? Claiming “they can afford it” is not an argument. The question isn’t affordability. If it were, we could simply take 90 percent of the wealth of Jeff Bezos, George Soros, and the rest of the Democratic donors. They’d still have billions of dollars to buy their yachts and live in their grand mansions.

This is a question of liberty versus tyranny. It’s a shame that most Americans don’t see it that way. They see it as giving the rich what’s coming to them. But wealth is property. Private property. And if anyone doesn’t think that the Democrats are going to go after everyone’s private property eventually, they haven’t been listening to Elizabeth Warren, AOC, or other radical Democrats who believe that private property is racist and unfair.

The rich can — and will — take care of themselves. It’s the principle of private property ownership that should concern us. Fighting for that principle doesn’t just benefit some of us. It benefits all of us.

Join the conversation as a VIP Member