Well, isn’t this ironic? Barney Frank, the former Massachusetts congressman who co-authored the controversial Dodd-Frank financial reform law in response to the 2008 financial crisis, was a director of Signature Bank of New York, which collapsed on Sunday, two days after the collapse of the Silicon Valley Bank.

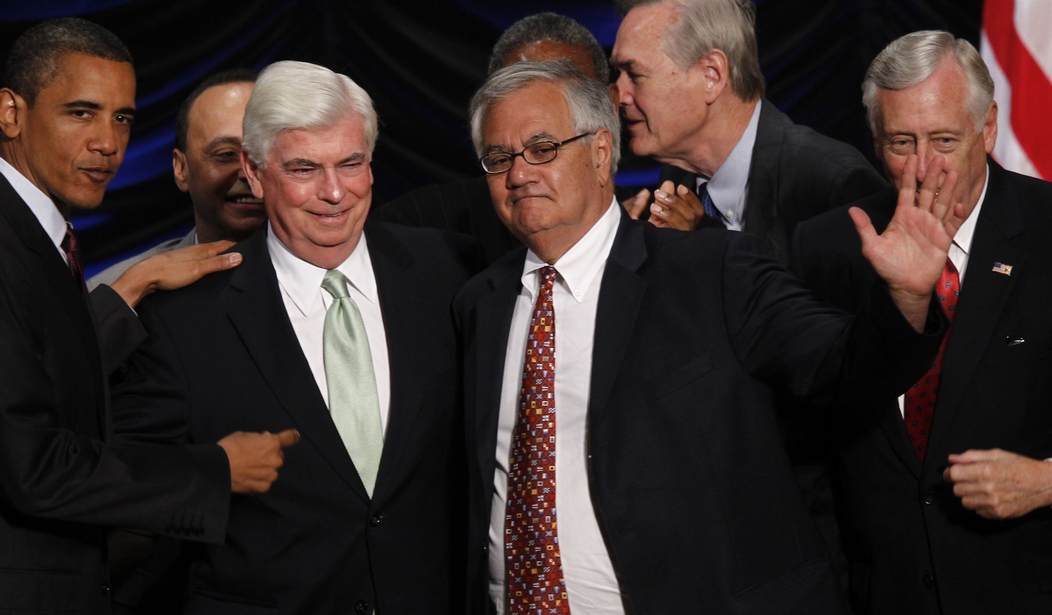

During the financial crisis, Frank served as the Democratic chairman of the House Financial Services Committee and played a key role in drafting the Dodd-Frank Act of 2010, which was supposed to prevent bank failures and bailouts like those that occurred in 2008 by establishing a whole boatload of new regulations for banks and created new government regulatory bodies tasked with overseeing financial institutions.

Now, some on the left have been rushing to blame the 2018 rollback of Dodd-Frank, which was signed by none other than Donald Trump himself, for the recent spate of bank collapses. But those accusations collapse under scrutiny.

In fact, the Dodd-Frank rollback was a rare moment of bipartisanship in an increasingly polarized Congress. It had the support of a whopping 258 Republicans and Democrats in the House and garnered the support of 67 senators, including 17 Democrats. Now, if that’s not a sign of unity, I don’t know what is.

Even Barney Frank supported those changes at the time and says they aren’t to blame for the recent bank failures.

“I don’t think that had any effect,” Frank told Bloomberg on Monday. “I don’t think there was any laxity on the part of regulators in regulating the banks in that category, from $50 billion to $250 billion.”

For our VIP Subscribers: No, Trump Isn’t to Blame for the Silicon Valley Bank Collapse

Still, how does the architect of the Dodd-Frank bill become the director of a failed bank? That’s rather humiliating, don’t you think?

Well, it should be, but since when do Democrats have any shame? Barney Frank certainly doesn’t. And why should he? He did survive a prostitution scandal back in 1989. So it isn’t exactly a huge leap for him to defend the law that is named after him after his own bank had to be taken over by federal regulators.

“The vindication of the bill is that nobody is talking about anything like 2008,” Frank claims. “If the bill hadn’t been passed, we’d be seeing a lot more damage these days. We got a lot of the vulnerability out of the system.”

I’ll give Frank credit for not joining the pathetic pile-on of Trump for something that is not his fault, but it’s still humiliating for him to be the director of a failed bank after having been the architect of legislation designed to prevent such failures.

Related: After Ignoring East Palestine, Biden Scrambles to Help Silicon Valley

Join the conversation as a VIP Member