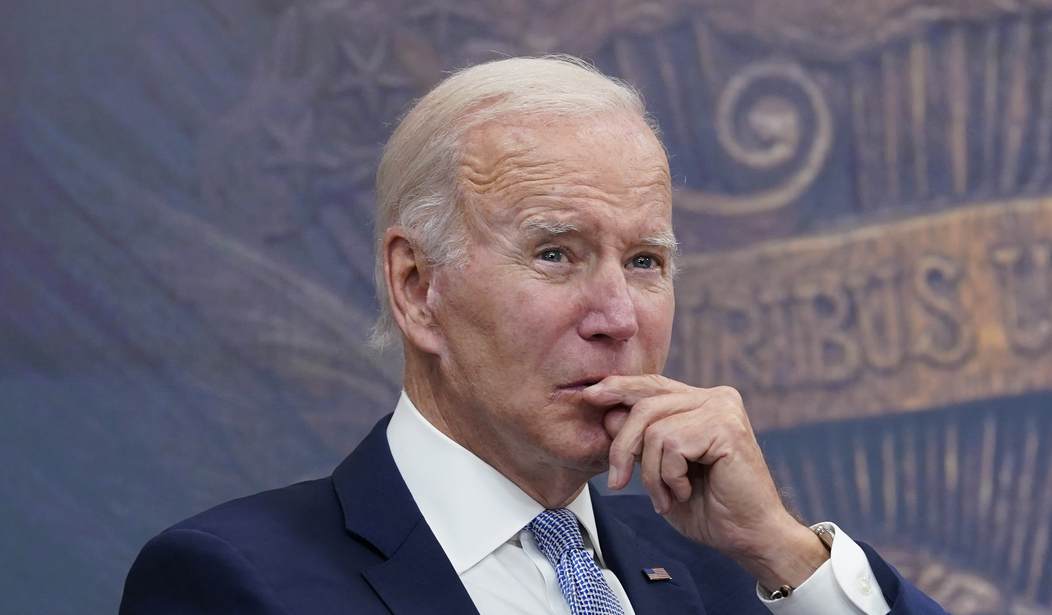

If you aren’t already concerned about the impact of Bidenflation (and you should be), you definitely will be after recognizing how the consequences of unchecked inflation affect much more than just the thickness of your wallet.

This year, inflation is set to cost the average American household an additional $11,500 just to maintain their standard of living, but that’s not all there is to it. Inflation is systemically destructive and as Dr. Thomas Hogan, Senior Research Faculty member for the American Institute for Economic Research (AIER) points out, “one of the biggest reasons for runaway inflation is the false premise that it’s actually good for the economy.”

“Inflation, indeed, throws a veil of illusion over every economic process. It confuses and deceives almost everyone, including even those who suffer by it.”

– Henry Hazlitt, American Economics Author and Journalist

“Hazlitt was right,” says Hogan. “Inflation obscures the economic process — and it’s definitely not necessary for growth.” In addition to weakening American spending power, “inflation can also have the negative side effect of slowing GDP growth. That’s no small matter.”

Related: Misery Index: Bidenflation Remains Sky-High, And Americans Aren’t Fooled

So with such far-reaching effects, what can the everyday American consumer do to mitigate the damage caused by current failed Democratic economic policies? In the latest issue of AIER’s Inflation Nation newsletter, Hogan lays out five hidden costs of inflation that “the Fed” — and Joe Biden & Co. — don’t want Americans to notice:

1) Higher Search Costs | This is when you have to spend more time looking for something. Like if you drive around looking for the best gas prices or go across town because there’s one store that hasn’t raised the price of TVs.

Mitigation: Utilize the internet to do all or most of the legwork when comparison shopping. Gone are the days of in-person browsing or traveling to the next town to save $3.00. Compare online, order online, and have it shipped whenever possible. For mom-and-pop local stores without a website, give them a call and have them hold the item(s) for pick up. Utilize credit cards that accumulate points for future purchases.

2) Higher Menu Costs | Businesses pay a price for adjusting their prices. Restaurants have to print new menus. Companies might print new signs or change their advertising. Contracts have to be renegotiated. We call these added costs ‘menu costs.’

Mitigation: Utilize apps and online menus to avoid “sticker shock” at the restaurant. Many restaurants allow you to accumulate points toward future purchases so use points or freebies whenever possible. Be sure to combine app accounts within your household to accumulate points faster. Utilize credit cards that accumulate points for future purchases.

3) Higher Planning Costs | Planning costs increase during inflation because business managers end up spending more time trying to minimize the negative effects of rising costs. Parents spend more time worrying about their household budgets and less time with their families.

Mitigation: Plan ahead, budget, and stay within your budget. Be aware that businesses are cutting back in size, selection, and sometimes quality to cut costs. Temper your expectations and spend your time and money as efficiently as possible.

4) Lower Productivity | The instability of the price level during inflationary periods creates uncertainty about the future, so businesses are less likely to hire more workers or invest in long-term projects. Lower investment in factories, equipment, research and technology reduces the rates of productivity and economic growth.

Mitigation: Be patient with the workers who do show up to work. Recognize the lower quality of service isn’t necessarily the fault of the overworked workers, but it may be a function of the uncertainty of the economy as a whole. Shop during off-peak hours and utilize apps as needed.

5) Misallocated Resources | Inflation can mislead businesses to overinvest or to invest in the wrong types of products, leading to wasted resources. [Hogan’s] colleague Peter C. Earle said it this way on a recent…podcast,…”When monetary expansion causes price inflation…the information content of prices is reduced…It’s much more difficult for entrepreneurs to figure out what the best use of resources is and in turn, it’s very difficult to determine whether a given profit is going to be profitable or not.”

Mitigation: Recognize that not all businesses will survive these tough economic times. For major purchases, be sure to patronize businesses that are likely to survive in case of future problems. Shop locally whenever possible and give your favorites some love on social media in the form of free personal recommendations. Save the petty complaints for another time.

Related: 20 Smart Ways to Save Money at the Pump

“A dynamic and growing economy means more jobs, more opportunities, and higher standards of living,” wrote Hogan. “However, inflation creates costs that hinder productivity, slow economic growth, and prevent Americans from reaching their full potential.” If you weren’t concerned about inflation, I imagine you are now, but remember, this too shall pass. Some day soon we will be back to a robust economy with leaders who actually love America and want her to prosper. Until then, don’t buy the spin, recognize what is really happening, and spend intelligently. And finally, vote in November 2022 and November 2024 as if your life, liberty, and fortune depend on it — because they do.

Join the conversation as a VIP Member