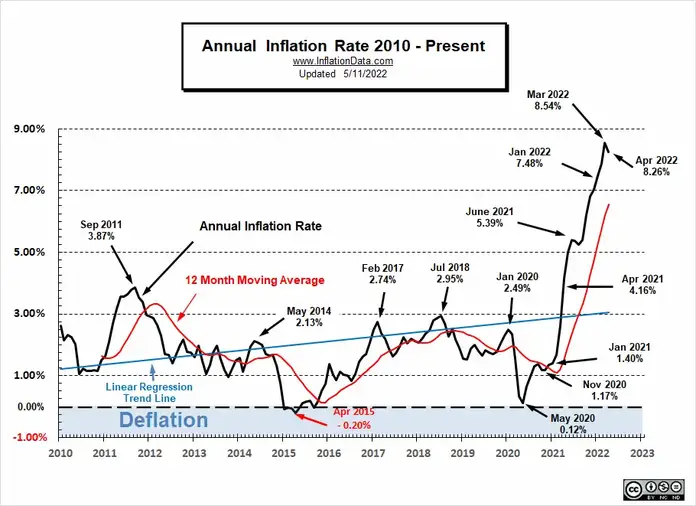

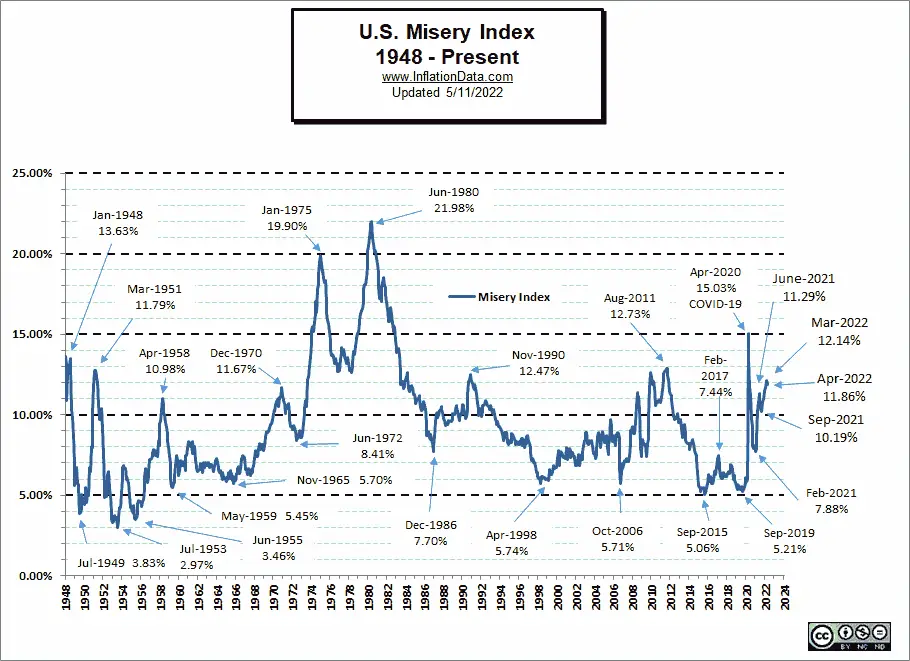

April’s atrocious federal inflation numbers released on May 11 showed the numbers ever so slightly improved from March; however, the overall health of the economy has not improved. Each month, economists use the most recent Bureau of Labor Statistics data to gauge the health of our economy. By adding the current U.S. unemployment rate of 3.6% to the current rate of U.S. inflation of 8.26%, economists quantify the economic well-being of the country into what is known as the U.S. Misery Index.

The current U.S. Misery Index stands at a still very miserable 11.86%.

Granted, the Misery Index is marginally lower this month than it was in March, but don’t be fooled by that decrease as the inflation rate remains at record-high levels not seen since the economically disastrous Jimmy Carter administration. Even so, the Misery Index is useful to gauge how the ups and downs of the U.S. economy under the Biden-Harris administration’s ruinous economic policies are impacting average Americans.

The problem is that, even though the Misery Index improved slightly over the previous month’s index of 12.14%, the economic situation has certainly not improved for the average American family’s wallet as consumer prices continue to climb ever higher.

So what exactly does the Misery Index tell us? First, we know that as the rate of inflation goes up, the cost of living increases. Next, as the unemployment numbers rise, more and more people fall into poverty. Consequently, the Misery Index acts as a kind of snapshot of time to gauge the health of the economy as a whole, since both unemployment and inflation significantly impact the average American wage earner’s spending power.

So what exactly does the Misery Index tell us? First, we know that as the rate of inflation goes up, the cost of living increases. Next, as the unemployment numbers rise, more and more people fall into poverty. Consequently, the Misery Index acts as a kind of snapshot of time to gauge the health of the economy as a whole, since both unemployment and inflation significantly impact the average American wage earner’s spending power.

Recommended: OUTRAGEOUS: American Infants Go Hungry While Biden Sends Baby Formula to Illegals

As the feckless Biden Administration gaslights, spins, and deflects blame for the soaring cost of living in the United States, most Americans are forced to tighten their belts by cutting back on everyday expenses like groceries, gasoline, and housing.

Price increases over last year (CPI report)

Gasoline: +43.6%

Used Cars: +22.7%

Gas Utilities: +22.7%

Meats/Fish/Eggs: +14.3%

New Cars: +13.2%

Electricity: +11.0%

Food at home: +10.8%

Transportation: +8.5%

Overall CPI: +8.3%

Food away from home: +7.2%

Apparel: +5.4%

Shelter: +5.1%— Charlie Bilello (@charliebilello) May 11, 2022

Unfortunately, everyday Americans have no choice but to pay exorbitant prices for food and energy. We all have to eat and drive our cars. What’s more, most Americans still need to heat their homes at night or cool their homes during the day, which means commodities like food, natural gas, and gasoline are taking bigger and bigger bites out of family budgets.

Gas prices in the US hit another record high ($4.40/gallon national average) with California closing in on $6.00. pic.twitter.com/8hpAKyuapZ

— Charlie Bilello (@charliebilello) May 11, 2022

And although it’s not just the United States feeling the squeeze of inflation, it’s obvious the U.S. is headed in the wrong direction. According to a survey by researcher Joanne Hsu, consumer sentiment regarding buying conditions under the Biden Administration’s economic policies is at its lowest since the late 1970s:

Consumer sentiment declined by 9.4% from April, reversing gains realized that month. These declines were broad based–for current economic conditions as well as consumer expectations, and visible across income, age, education, geography, and political affiliation–continuing the general downward trend in sentiment over the past year. Consumers’ assessment of their current financial situation relative to a year ago is at its lowest reading since 2013, with 36% of consumers attributing their negative assessment to inflation. Buying conditions for durables reached its lowest reading since the question began appearing on the monthly surveys in 1978, again primarily due to high prices.

Simply put, inflation decreases the purchasing power of consumers. Higher prices mean that consumers can purchase fewer goods, so even as Americans return to work after the economic disruptions of the pandemic, their wages, savings, and investments buy less and less the higher inflation rises. Add the recent higher mortgage rates to the mix, and many American families are now priced out of the housing market.

The 30-year mortgage rate in the US rises to 5.30%, its highest level since 2009 and double the all-time low of 2.65% from last year. pic.twitter.com/TxxJhosutd

— Charlie Bilello (@charliebilello) May 12, 2022

The sad fact is that, even though consumers haven’t done anything wrong, inflation acts as a tax, and the mere passage of time increases the prices of everyday goods and services such as housing, food, and transportation. Under these conditions, when and if workers get raises, inflation eats up any gains. In other words, American consumers’ money doesn’t buy as much as it used to, and life becomes more and more expensive through no fault of their own — unless, of course, they voted for the bumbling Biden and his incompetent economic skills.

Join the conversation as a VIP Member