WASHINGTON – A group of House Democrats came out against President Trump’s tax reform plan on Wednesday, arguing that it would disproportionately help the wealthiest taxpayers in America.

Congressional Republican leaders have proposed reducing the number of tax brackets from seven to three. GOP leaders are reportedly considering a fourth bracket no higher than 39.6 percent, which is the existing top tax rate. The GOP proposal also includes lowering the corporate tax rate to 20 percent.

Pocan was asked if he would vote for a 20 percent corporate tax rate separate from the rest of the Republican proposal.

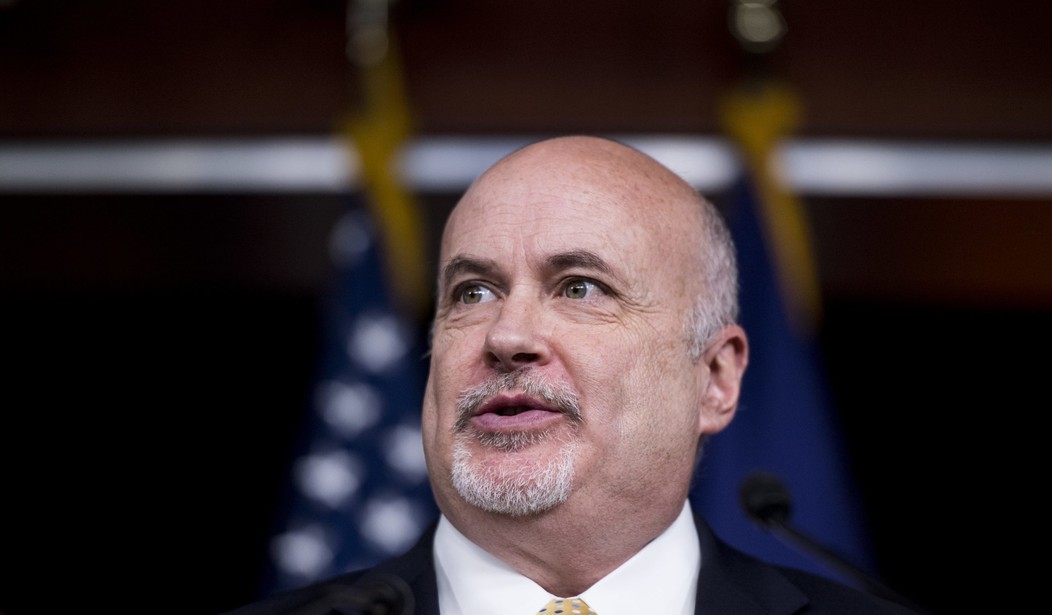

“We’ll have to see what they put together. What we know right now is anything that’s going to put more money focused on the wealthy rather than to the middle class and those aspiring to be in the middle class is a non-starter for us,” Rep. Mark Pocan (D-Wis.) told PJM after speaking at a press conference with the Congressional Progressive Caucus.

“So far, I know it’s a skeletal plan. But what we’ve seen them put out there looks like it’s going to cost the middle class money to provide tax cuts to the wealthy, and that’s what we’re opposing. Any focus on taxes has to prioritize the middle class and not just shift money to the wealthy,” he added.

Pocan predicted that Republican leaders are going to have a “hard time” convincing their own members to support the tax reform proposal in its current form.

“Part of why we have said from the beginning that tax reform is difficult is because we have a lot of folks that have a lot of different loopholes, I would call them, that come in and want us to protect what they have,” he said. “And I think [Republicans] are going to have a hard time getting this done, period, for their own members. But for Democrats, I think, our focus is making sure that the middle class are at the forefront of anything that goes forward, and right now their plan doesn’t do that.”

Rep. Keith Ellison (D-Minn.) said the GOP tax plan would exacerbate income inequality in the United States.

“This whole tax fight happens at a time when income and wealth inequality has not been worse than since the gilded age in 1890,” he said. “This fight is happening at a time when things have never been tougher for working people, and nobody can remember when they were worse. So keep that in mind as we fight on, because you need to know the Progressive Caucus cannot win this battle alone.”

Ellison said anyone who supports research funding for diseases or whose home might be hit by a natural disaster should oppose the Republican tax plan.

“They want to blow a hole in that budget and then they want to say, ‘oh, we just can’t afford Head Start, you know, we’d like to support it but we just can’t do it.’ This is the whole point. They want to increase their private wealth, decrease our public wealth so they can take the extra money and buy more politicians in the building right behind us,” he said in front of the Capitol.

“You better believe that extra money is not going into jobs or investment but it will be going into the hands of campaign donations and lobbying. You can better believe that… This is the fight of a lifetime. This is what they really, really want. We better buckle up and organize all over the country and defeat this tax plan, because if we can defeat this tax plan we will deliver a devastating blow to the plutocrats,” he added.

Rep. Rosa DeLauro (D-Conn.) said the GOP tax plan violates Trump’s campaign pledge to help the forgotten men and women of America.

“Where is the commitment to, and I quote what he said, the forgotten men and women of our country, end quote. There is no commitment to these folks, none. We need a tax plan that works for working families, not for millionaires and for billionaires,” she said. “While this proposal recognizes the importance of improving the child tax credit, it leaves behind the most vulnerable families who are struggling to get by.”

Join the conversation as a VIP Member