The last three meetings of the Federal Reserve Board of Governors have seen a rise of .75 points in interest rates as the Fed seeks to try to cool the rise in prices.

It’s not working. The Consumer Price Index for September was released and it shows prices rose 0.4% in September from the previous month. Prices climbed 8.2% on an annual basis. Both those numbers were higher than economists were forecasting.

More worrisome, core inflation, which removes volatile elements like food and fuel, rose at a rate of 0.6% in September from the previous month. From the same time last year, core prices jumped 6.6%, the fastest since 1982.

Stocks tanked on the surprisingly hot report, with the Dow Jones Industrial Average down more than 500 points. The S&P 500 tumbled 2.10% and the Nasdaq Composite slipped 2.80%.

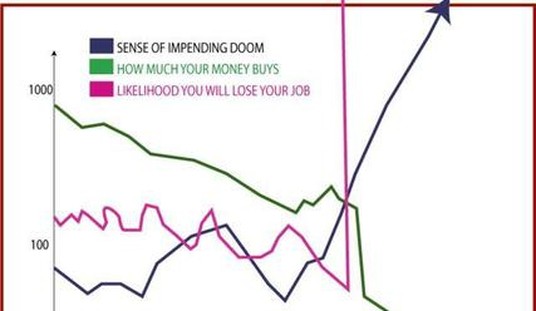

Scorching-hot inflation has created severe financial pressures for most U.S. households, which are forced to pay more for everyday necessities like food and rent. The burden is disproportionately borne by low-income Americans, whose already-stretched paychecks are heavily impacted by price fluctuations.

Although households continued to see some reprieve last month in the form of lower gas prices, which fell 4.9% in September from the previous month, other price gains proved persistent and stubbornly high.

“The composition of the inflation reading is perhaps even more worrisome than the overall number,” Seema Shah, the chief global strategist at Principal Asset Management, told Fox Business. “Increases in shelter and medical care indices, the stickiest segments of the CPI basket, confirm that price pressures are extremely stubborn and will not go down without a Fed fight.”

And that fight continues. The Fed appears to be the only warrior in this battle, as the president and Congress have abnegated their responsibilities and refuse to do what’s necessary to help tame inflation. Cutting spending would be a very good start.

Inflation is now being driven by expectations of price increases as much as actual pressures on costs. This begets an inflationary spiral that can easily get out of control and make matters much worse.

Rampant inflation and the rapid dissolution of Americans’ buying power have become major political liabilities for Biden ahead of the November midterm elections, in which Democrats are expected to lose their already razor-thin majorities. Surveys show that Americans see inflation as the biggest problem facing the country – and that many households blame Biden for the price spike.

The president has blamed higher prices on greedy corporations, supply chain bottlenecks and other pandemic-induced disruptions in the economy, as well as the Russian war in Ukraine. Most economists now agree that unprecedented levels of government stimulus and a stronger-than-expected recovery from the pandemic have also played at least some role in exacerbating the price spike.

This is the last scheduled release of the CPI report before the election. There’s nothing that Joe Biden can do to wash the bitter taste out of the mouths of voters who will go to the polls in a foul mood about rising costs.

Join the conversation as a VIP Member