On Wednesday, the Federal Reserve raised its benchmark rate a quarter of a percentage point, the second rate hike this year.

Experts now say that there will be four rate hikes this year altogether, as inflation inches up to over 2% — a worry because of the growing strength of the economy and wages being on the rise.

The decision reflected an economy that’s getting even stronger. Unemployment is 3.8%, the lowest since 2000, and inflation is creeping higher. The Fed is raising rates gradually to keep the economy from overheating.

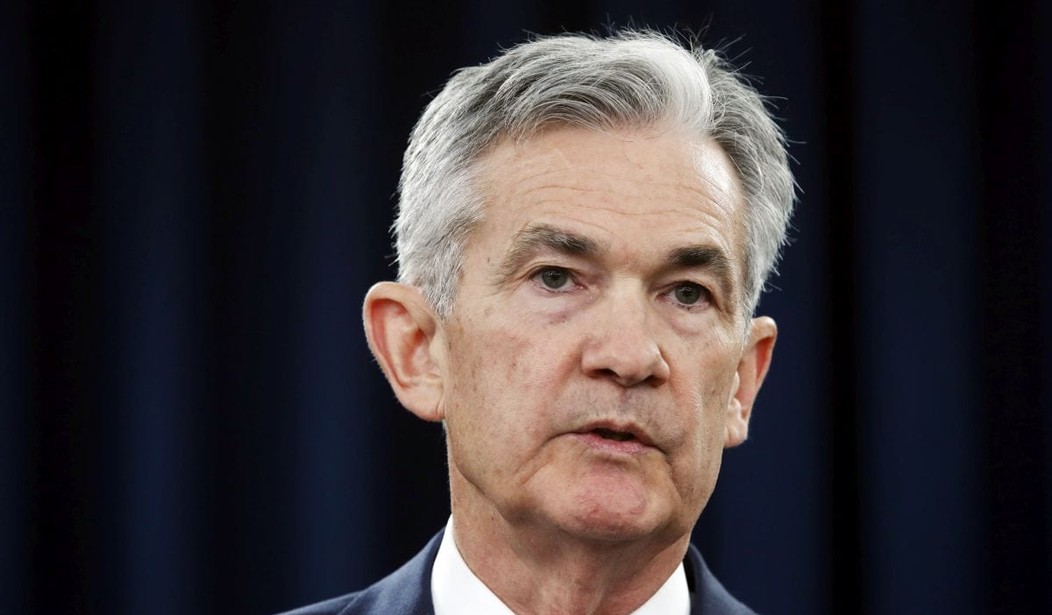

“The main takeaway is that the economy is doing very well,” Fed Chairman Jerome Powell said at a news conference. “Most people who want to find jobs are finding them, and unemployment and inflation are low.”

The Fed lifted the federal funds rate, which helps determine rates for mortgages, credit cards and other borrowing, to a range of 1.75% to 2%.

“By just tapping the brakes more quickly, but not harder, the Fed is showing it’s willing to let the economy and the expansion run,” said Robert Frick, corporate economist with Navy Federal Credit Union.

For the last decade, inflation has been historically low, reflecting the effects of the recession and a sluggish economy. Wages have remained stagnant over that period of time, relieving inflationary pressure.

But wages are rising along with stronger economic growth. This, apparently, is worrying the money mandarins at the Fed:

The Fed’s decision Wednesday was driven by “indications that inflation is right around the corner,” said Jason Reed, an economist and finance professor at the University of Notre Dame’s business school.

Inflation has been mysteriously low during the long economic recovery. But it has finally passed 2%, the level the Fed considers healthy.

The Fed’s preferred measure of inflation, which strips out food and energy prices, climbed in May to 2.2% and registered the biggest annual jump in six years. The Fed expects inflation higher than 2% over the next two years, according to its latest projections.

Powell said the Fed would be worried if inflation either persistently overshoots or undershoots the 2% target. He pointed out that inflation can “bounce around” over time, especially with a spike in global oil prices likely to raise prices.

Still unknown are the effects that Trump’s tariffs will have on the economy, although the signs are not good:

“I think it’s fair to say you’re beginning to hear reports of companies holding off on making investments and hiring people,” he said.

Powell declined to comment on any specific policy, but he said Fed officials around the country are reporting concerns from businesses.

“Right now we don’t see that in the numbers at all. The economy is very strong,” he stressed. “I would put it down as more of a risk.”

Risk makes the Fed jittery and a jittery Fed is not a good omen for interest rates. The important thing to stress is that the Fed is reacting to the potential for inflation; it’s still very manageable.

Join the conversation as a VIP Member