Rumors were flying all over the continent on Saturday night that a deal had been reached to recapitalize Cypriot banks with a 10 billion euro bailout. But a government spokesman shot down the stories after talks broke up early Sunday morning with no resolution to the crisis.

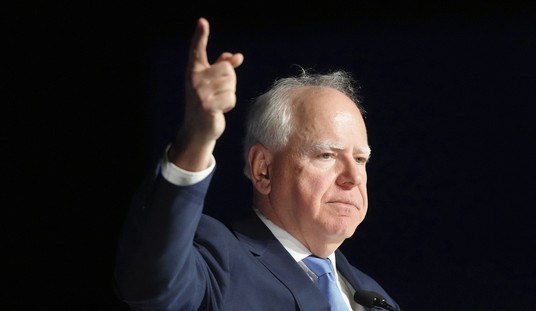

Cypriot President Nicos Anastasiades, left his quarreling government and jetted off to Brussels, where he will meet with EU finance ministers in a matter of hours to plead his case that Cyprus has done enough to deserve the bank bailout.

The government has proposed a “tax” of 20% on deposits over 100,000 euros held by the country’s biggest bank, and a 4% levy on similar deposits held at other banks. But the amount raised will fall short of the 5.8 billion euros the EU is demanding as a price for the bailout. They have also proposed winding down the country’s second largest bank. They toyed with the idea of seizing semi-private pensions, but Germany nixed that idea, comparing it to the original plan to give a 6% haircut to ordinary depositors.

All of this takes place against the backdrop of a Monday deadline issued by the European Central Bank, who has been pumping billions of euros into the Cypriot banking system during the emergency. The ECB has told the Cypriot government that without a deal, they will stop the flow of funds and allow the banks to fail. If the banks can’t open on Tuesday, an economic meltdown is virtually guaranteed as is Cyprus’ exit from the euro.

Even if President Anastasiades is able to convince the EU to go along with the plan to give big depositors a haircut, he must still get approval from the Cypriot parliament. The legislature has already granted the government extraordinary power to effect capital controls, but the haircuts — even if they’re only for the rich — are political poison. With the alternative nearly unthinkable, it is likely that the politicians will swallow hard and vote for the bailout package.

Just what would the alternative look like?

Banks in Cyprus have been closed to prevent a run on deposits after initial plans for a tax on all accounts — since abandoned — were revealed last weekend. ATMs have continued to function but long queues have formed at some banks.

In the absence of a rescue, Cypriots and foreign depositors will rush to withdraw cash as soon as they can. The government could extend the bank holiday again, and impose limits on financial transactions, but that would only delay the inevitable.

“The longer the restrictions on withdrawing and transferring assets continue, the more it increases the chances of drastic capital flight once they are lifted,” wrote IHS Global Insight analyst Sean Harrison in a report.

Restricting the movement of capital wouldn’t solve the country’s banking crisis but only further depress activity in a recession-hit economy dependent on financial services and tourism, exacerbating the government’s debt crisis.

Cyprus could close its two weakest banks — it is already working on a plan to restructure one of them, Popular Bank of Cyprus — but depositors would face big losses, further undermining confidence in the system as a whole.

Unable to restore trust in its banks and with an economy locked in a downward spiral, social and political unrest would escalate quickly. At that point, Cyprus may decide it has no option but to abandon the euro and start printing its own currency.

A new Cyprus pound would be worth much less than the euro, imposing even more pain on depositors than the original bank levy rejected by parliament on Tuesday.

Richard Fernandez explains the psychology of a potential meltdown:

I have often written that the world crisis is at heart a crisis of information. The correspondence between physical things and the abstract financial system that values them has fallen out of sync. It cannot remain this way. The financial database is full of lies; and parenthetically, the political system, which is the handmaiden of the financial system, is as full of lies as well. Somehow they have to be brought into near alignment again.

Pretending that space aliens are going to invade, as Paul Krugman suggests, as an excuse to print money, or deciding we can borrow ‘infinite amounts’ as Bloomberg says, ain’t gonna work.

The challenge in the coming years is to unwind this deficit. The challenge is to bring the official narrative into line with the physical facts. If we won’t do it willingly then reality will do it for us. Guaranteed. Whatever the media or political or financial elite say one fact has remained unchanged since the beginning of the world. Nobody ever beat arithmetic.

Some analysts believe Cyprus is doomed no matter what happens. But anyone who has been watching the slow motion unraveling of the EU these past years knows that the politicians have become expert at kicking the can down the road, hoping against hope that something will turn up. How long Cyprus can limp along is anyone’s guess, but the illusion of stability will probably be enough to allow the tiny island nation to go on pretty much as before — albeit a little lighter up top for the rich who have parked their cash offshore.

Join the conversation as a VIP Member