James Pethokoukis at the Enterprise Blog on the March jobs numbers:

Swing and a miss. A big miss. A really big miss. U.S. employers added just 120,000 jobs last month, the Labor Department said on Friday. That’s the smallest increase since October. Economists polled by Reuters had expected nonfarm employment to increase by 203,000. And as economist Robert Brusca points out, “The strong amazing run in household jobs came to a crashing halt as employment in that survey fell by 31,000 after rising by 42,000 last month and 847,000 the month before that.”

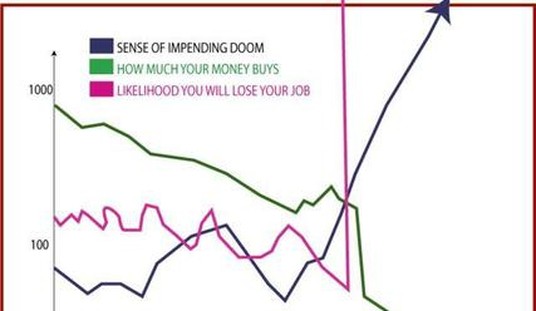

Then there’s the unemployment rate, which dipped to 8.2% from 8.3% the month before. That extends the longest streak of 8%-plus unemployment since the Great Depression. The U.S. economy hasn’t been below 8% unemployment since Obama took office in January 2009. And back in May 2007, unemployment was just 4.4%. (And keep in mind that average hourly wages are up just 2.1% over past year. But inflation up 2.9% (2.2% core). American workers are losing ground.) As Barclays Capital puts it: “Overall, the report had an undeniably weak tone and will raise doubts about the strength of the labor market. Given that the report reflects only one month of data and some of the underlying cyclical sectors registered payroll gains, we do not view it as conclusively signaling a shift to a lower trend rate of employment growth.”

[…]

1. If the size of the U.S. labor force as a share of the total population was the same as it was when Barack Obama took office—65.7% then vs. 63.8% today down from last month—the U-3 unemployment rate would be 10.9%.

2. But what if you take into the account the aging of the Baby Boomers, which means the labor force participation (LFP) rate should be trending lower. Indeed, it has been doing just that since 2000. Before the Great Recession, the Congressional Budget Office predicted what the LFP would be in 2012, assuming such demographic changes. Using that number, the real unemployment rate would be 10.5%.

3. Of course, the LFP rate usually falls during recessions. Yet even if you discount for that and the aging issue, the real unemployment rate would be 9.4%.

4. Then there’s the broader, U-6 measure of unemployment which includes the discouraged plus part-timers who wish they had full time work. That unemployment rate, perhaps the truest measure of the labor market’s health, is still a sky-high 14.5%.

5. The employment-population ratio dipped to 58.5% vs. 61% in December 2008. An historically low level of the U.S. population is actually working.

Take some Dramamine before reading the White House spin on these numbers. You’re going to need it:

There is more work to be done, but today’s employment report provides further evidence that the economy is continuing to recover from the worst economic downturn since the Great Depression. It is critical that we continue to make smart investments that strengthen our economy and lay a foundation for long-term middle class job growth so we can continue to dig our way out of the deep hole that was caused by the severe recession that began at the end of 2007.

[…]

Despite adverse shocks that have created headwinds for economic growth, including weak construction investment, the economy has added private sector jobs for 25 straight months, for a total of 4.1 million jobs over that period.

The White House Tilt-a-Whirl statement notwithstanding, we are a breath away in the Middle East or southern Europe from slipping into another recession — that is, if you live in an area of the country that has been lucky enough to get out of the previous recession in the first place. There are still huge swaths of America where you can’t find a job, where business activity is at a near standstill, and where new business creation is non-existent. Nothing has changed for many Americans since the housing collapse and credit crunch. This despite trillions of dollars in “stimulus,” a “Recovery Summer,” a slew of “jobs bills,” and assurances that things are getting better.

No, really.

Join the conversation as a VIP Member