The liberal media may not be willing to admit it, but United States is teetering on the brink of a full-blown recession, and the dock workers strike could push it over into one.

According to Piper Sandler economist Jake Oubina, the U.S. is already experiencing an industrial recession, as manufacturing activity has contracted for six consecutive months, according to the latest Institute of Supply Management (ISM) report. If oil prices spike, Oubina warns that the increase could push the economy over the edge, plunging us into a deeper recession.

"Oubina, a managing director and senior economist at the investment bank, pointed to the continued slowdown in the manufacturing sector, with activity contracting in September for a sixth straight month," reports Business Insider. "It also marks the 22nd monthly contraction over the last 23 months, according to the latest report from the Institute of Supply Management."

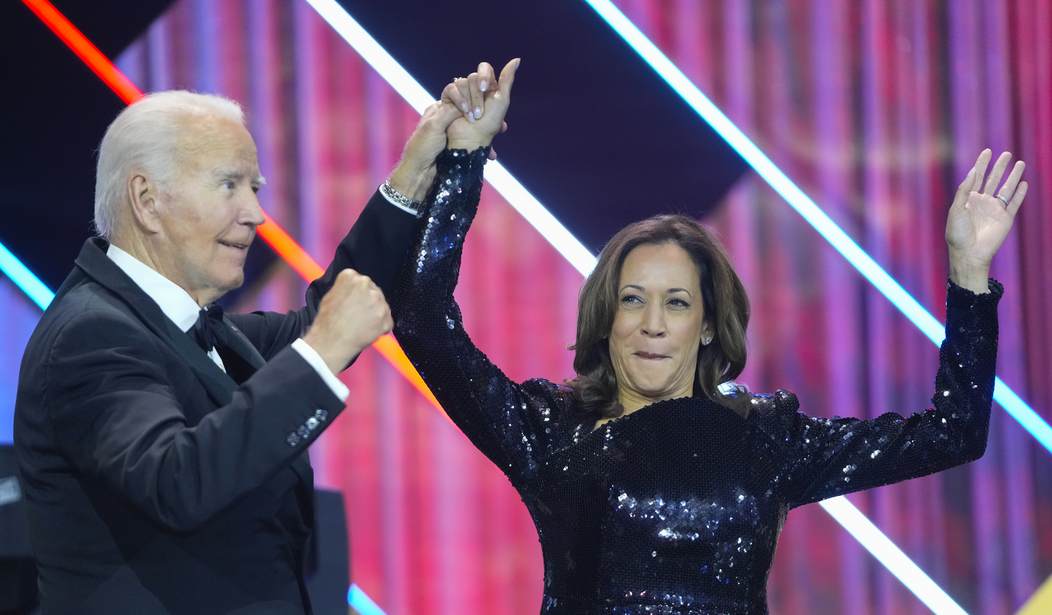

For our VIPs: Kamala May Have Torpedoed Her Campaign With This Move

"The only things that are up are things that are financed by chips, [the Inflation Reduction Act], all the high-tech stuff, fueling data centers, semiconductors, etc. That's been up. But in general, the economy's showing an industrial recession," Oubina told Fox Business on Tuesday.

The economy could slip into a broader recession if there's a spike in oil and energy prices, Oubina added. That's in line with what other economists have warned, with some pointing to the oil price shock that triggered a downturn in the 1970s.

Brent crude, the international benchmark, soared this week after Iran launched a missile attack on Israel, sparking fear of supply disruptions.

This is ominous news considering that on Tuesday, port workers launched their first strike since 1977, shutting down U.S. Atlantic and Gulf of Mexico ports and disrupting a crucial part of the nation’s supply chain. The strike, led by the International Longshoremen’s Association (ILA) and the United States Maritime Alliance (USMX), is expected to have a severe economic impact, potentially costing billions daily and worsening inflation. Experts say that if both sides do not quickly resolve the port workers strike, it could disrupt the oil and gas industry.

Joe Biden has the authority to halt the strike under the Taft-Hartley Act, but both he and Kamala Harris have sided with the unions.

“This strike is about fairness. Foreign-owned shipping companies have made record profits and executive compensation has grown. The Longshoremen, who play a vital role transporting essential goods across America, deserve a fair share of these record profits,” Kamala said in a statement.

The Biden-Harris administration has no plans to invoke the Taft-Hartley Act to stop the strike.

The escalating conflict in the Middle East is already driving up gas and oil prices. This week, Brent crude, the global benchmark, surged after Iran launched a missile strike on Israel, stoking fears of widespread supply disruptions. As tensions rise, the potential for further instability in oil markets becomes more likely, adding pressure to already strained energy prices.

"I think of the biggest risk of that, right, a retaliation by Israel that actually targets oil production facilities," Oubina told Business Insider. "Oil prices spiking, energy prices spiking in the past, have been enough to tip the economy from a slowing into a recession. So I think that's what we have to worry about."

Join the conversation as a VIP Member