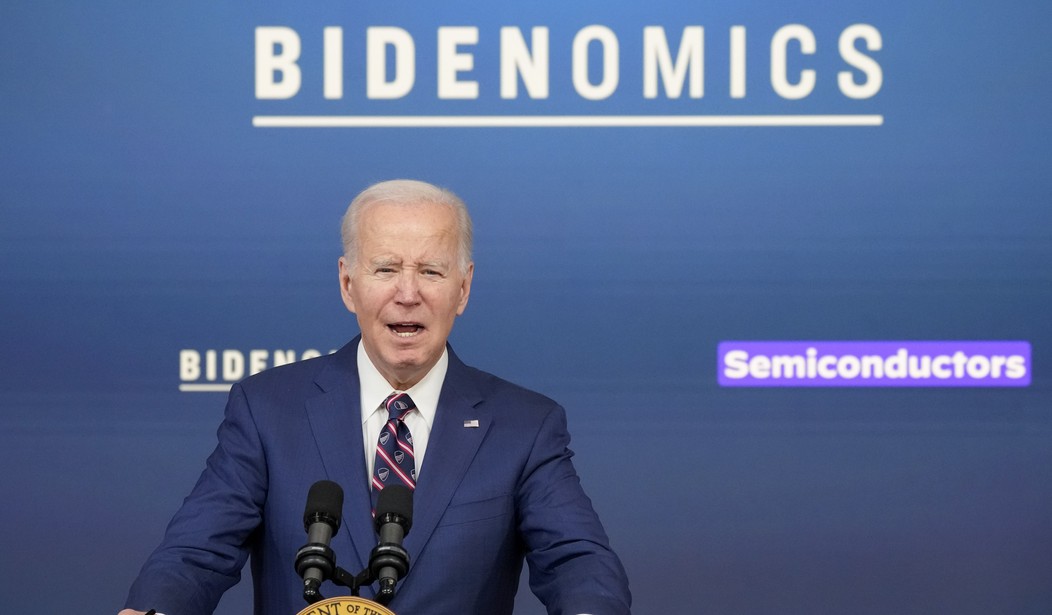

According to Joe Biden, Americans are experiencing unprecedented prosperity on his watch. After all, he’s created, like, six trillion jobs or something, right? On top of that, he says inflation is down, wages are up. Everything is just great! All hail Bidenomics!

Or not. According to a new report, housing affordability "is the worst it has been in decades," and "the typical salary required nationwide for homeownership is up to $106,500,” which is an insane 61% increase compared to just four years ago, when it was just $59,000.

Fox Business has more.

Home foreclosures rose again in February as Americans continue to grapple with the ongoing cost-of-living crisis.

That is according to a new report published by real estate data provider ATTOM, which found that there were 32,938 properties in February with foreclosure filings, which includes default notices, scheduled auctions and bank repossessions. That marks an 8% increase from the prior year, although it is down 1% from the previous month.

"The annual uptick in U.S. foreclosure activity hints at shifting dynamics within the housing market," said ATTOM CEO Rob Barber. "These trends could signify evolving financial landscapes for homeowners, prompting adjustments in market strategies and lending practices."

Pretty much the only good thing here is that foreclosures haven’t reached levels from the 2008 financial crisis, but there’s still time.

But the problem could soon get worse as high home prices, mortgage rates and property taxes bite Americans.

Housing affordability is the worst it has been in decades, thanks to a spike in home prices and mortgage rates. Combined, the two have helped to push the typical salary required nationwide for homeownership up to $106,500 — a stunning 61% increase from the $59,000 required just four years ago, according to Zillow.

There are several reasons to blame for the affordability crisis.

The Federal Reserve's aggressive interest-rate hike campaign sent mortgage rates soaring above 8% for the first time in nearly two decades last year. Rates have been slow to retreat, hovering near 7% as hotter-than-expected inflation data dashed investors' hopes for immediate rate cuts.

Expanding access to homeownership has been a goal of the Biden administration. Last year, the White House touted Joe Biden’s "historic investment to lower housing costs, expand housing supply, improve access to affordable rental options and homeownership, and advance efforts to end homelessness,” which was a laundry list of various programs the White House claimed would create more affordable housing, making renting more affordable, and expanding homeownership opportunities for first-time homebuyers.

Related: The Inflation Issue Isn’t Going Away, and That’s a Problem for Biden

Months later, the White House insisted its efforts were working, including the claim that the American Rescue Plan’s Homeowner Assistance Fund (HAF) had "assisted nearly 400,000 homeowners at risk of foreclosure."

"Bidenomics means you can't cover your mortgage,” Rep. Jeff Duncan (R-S.C.) said in a post on X/Twitter. "Foreclosures are going up while home affordability is at its worst. In my home state of South Carolina, foreclosures increased 51%. Joe Biden’s economic policies are failing America." Credit card delinquency also surged by 50% last year.

Join the conversation as a VIP Member