The Federal Reserve has some not-so-comforting inflation news for Americans: They can’t tame it, and it isn’t their fault.

The current “increase in inflation,” says a new report published by the Kansas City Federal Reserve, “could not have been averted by simply tightening monetary policy.”

The Fed was established in 1913 to promote economic stability by protecting the value of the dollar.

If they can’t do it, who can?

That’s where things get complicated, as you’ll see.

Skip this next excerpt if you like, because I’ll have a TL;DR version for you just below it.

The report, written by Leonardo Melosi of the Chicago Fed and John Hopkins economist Francesco Bianchi goes on to say:

Trend inflation is fully controlled by the monetary authority only when public debt can be successfully stabilized by credible future fiscal plans. When the fiscal authority is not perceived as fully responsible for covering the existing fiscal imbalances, the private sector expects that inflation will rise to ensure sustainability of national debt. As a result, a large fiscal imbalance combined with a weakening fiscal credibility may lead trend inflation to drift away from the long-run target chosen by the monetary authority.

Here’s the TL;DR: Inflation is raging because Congress is spending money we don’t have, is producing trillion-dollar deficits with no end in sight, and has no intention (much less an actual plan) of reining it in.

Michael Maharrey adds:

Make no mistake, the US government is spending far beyond its means. Although the budget deficit is shrinking as emergency pandemic spending programs wind down, the Biden administration continues to spend about half-a-trillion dollars every single month, piling onto the ever-ballooning deficit.

The current “plan” is that Congress will spend nearly 50% more than it will take in, month after month, year after year, and pretend that’s sustainable.

Meanwhile, our idiot POTUS puppet conjured up perhaps as much as another trillion dollars in transfer payments from the poorest Americans to the richest, cloaked as “college loan debt relief.”

Can he do that? Well, who’s there to stop him?

But back to inflation — and let’s forget about interest rates.

Here’s what that Federal Reserve paper doesn’t say: If Congress is the husband who’s drunk on spending, then the Fed is the codependent wife driving him safely home from the bar each night.

Congress could never get away with multi-trillion dollar deficits if they weren’t enabled by the mad money minters at the Federal Reserve.

Recommended: California Warns: Here Come the Blackouts, Don’t Charge Your Car

When Congress wanted to provide “relief” from the totally unnecessary COVID-19 lockdowns, Minneapolis Fed President Neel Kashkari went on 60 Minutes to assure people that the Fed has basically an “infinite amount of cash.”

Two years later, you can still feel the “assurance” every time you buy groceries.

The point is, every time Congress wanted to spend a couple trillion dollars we didn’t have, there was the Fed to monetize it — IE, roll the digital printing presses 24/7.

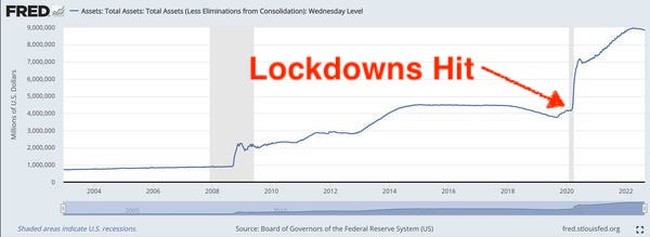

Here’s the Fed’s balance sheet since 2000:

When the Fed owns assets — the bank’s balance sheet — it’s because they bought it. Where does the Fed get the money to buy things?

They print it. Convenient for them, no?

Since March of 2020, the Fed has bought $5,000,000,000,000 worth of assets using funny money. They just injected craploads of new dollars into circulation, in no small part to cover Congress’ largess.

Cut. It. Out.

So long as the Fed can print money at will, there’s absolutely nothing to stop Congress from spending money we don’t have.

The fate of the world’s largest economy is in the hands of a codependent couple. One has no interest in the welfare of the country as a whole, and the other apparently has no interest in taking responsibility for its part in letting that happen.

Join the conversation as a VIP Member