In comments yesterday I mused on what the new financial regulations proposed by President Obama would bring.

As important as the Supreme Court decision was it is almost overshadowed by the President Obama’s proposals to get banks out of the private equity business, the main idea being to bar the banks from playing in riskier markets. The main obvious difficulty with this proposal is that unless other national environments go synchronize their move then US banks may be at a competitive disadvantage. So noises are being made about settling it within the framework of an international deal.

Obama’s initiative will garner a the support of those who believe that some return to Glass-Steagal, abolished by Clinton in 1999, is desirable. It will also play to the popular resentment of the financial industry. To some extent, this will be government trying to destroy its own monster, at least one it helped in part create.

The two problems facing the monster slayers are that it may in the short term affect the amount of credit and capital available. More importantly, it may have no effect. Given the mobility of money pathways are likely to evolve in which deposit money is effectively staked on high risk ventures. Government itself did this by encouraging the bundling of subprime mortgages and when that bombed the effects rang through the whole system.

In short, the President wants to firewall off different parts of the financial system by rebuilding some of the walls which had been torn down in the past. In order to successfully achieve this, he has to do it right. Doing it wrong will be fraught with danger. It is a gigantic task, requiring international cooperation, timing and attention to detail. And unless done correctly it may result in an expensive disaster.

Can Obama do it? Can the political system do it? My guess is that he’ll have a hard time for two reasons. First, it is a bait and switch again. He is rounding on Wall Street, which is not a bad thing in itself, but to do that he will need to enlist the help of political forces he’s already betrayed. One of the subtexts is that Wall Street may have thought they had an understanding, and now maybe they don’t. Rightly or wrongly, that the double-cross factor. Second, he will have to craft the financial regulatory overhaul carefully. It can blow up in his face. But given the cast of characters he has at Treasury it is certain some of them will be conflicted, some probably thinking past the time when the Obama administration will be over and their professional lives not yet. Obama needs a political parachute to save his plumetting Presidency, and this initiative has many positives going for it; but his capacity to execute is may be severely impaired.

My prediction? Anything can happen. It may be a big victory for Obama, an impending disaster or anything in between. But it will severely challenge the Republican response. I think more details will emerge in the days ahead and when the nuts and bolts shine through the rust, it will be clearer whether the administration’s proposal reduces risk without unduly throttling credit. Most important, we’ll see whether the risk reduction is roughly symmetrical over all actors, or whether some will be more restricted than others.

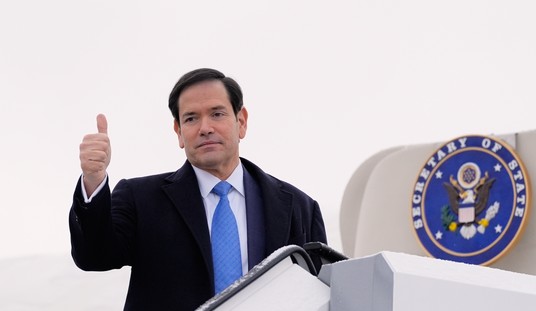

Some of those conjectured results are showing up. Now Treasury Secretary Timothy Geithner is apparently signalling that he is not completely onboard, an extraordinary action for a cabinet member supposedly spearheading the effort. In other words, he’s hedging. Reuters reports:

U.S. Treasury Secretary Timothy Geithner has expressed some skepticism behind closed doors about the broad bank limits proposed on Thursday by his boss, President Barack Obama, according to financial industry sources.

The sources, speaking anonymously because Geithner has not spoken publicly about his reservations, said the Treasury chief is concerned the proposed limits on big banks’ trading and size could impact U.S. firms’ global competitiveness.

This complaint about competitiveness was going to come up early and was one of the obvious objections. Another Reuters story said that European governments welcomed Obama’s initiative but had no plans to follow suit as yet. “Major European economies offered support on Friday for U.S. President Barack Obama’s plan to limit banks’ size and trading activities but indicated they had no plans to follow suit. … ‘The U.S. finds itself a little behind us on this. The Obama plan is not fit for the purpose in the EU.'” It’s like Alphonse and Gaston entering the dragon’s lair. You first, Obama.

Unless European banks are held to the same restrictions then they could probably offer deals under one roof that US banks would need external partners to match. But if the US banks did that then in the course of events they might circumvent the very prohibitions against using depositor money in high-risk situation the reform was designed to prevent. A level international playing field would probably help ameliorate the incentives for finding loopholes.

The Reuters article quotes an unnamed source as implying Geithner said that Obama’s banking reforms might be missing the real point.

He also has concerns that limits on proprietary trading do not necessarily get at the root of the problems and excesses that fueled the recent financial meltdown, the sources said….

The White House official said Obama’s economic team considered the concern that proprietary trading was not at the heart of the problems that fueled the financial crisis.

But it concluded that reform needed to be about more than just fighting the last war, it needed to address sources of future risk as well, the official said.

Well, what is the real point? What are the true sources of future risk? That’s the $64 trillion question which the Reuters article doesn’t answer: what the greatest sources of unmanaged risk are. The use of depositor funds in high risk markets is one element, but there are others. The housing bubble, excessive financial complexity, lack of information, the incorrect pricing of risk through CDOs all played their part. Unless these sources of risk are systematically managed — including those factors caused by government — then the financial reform effort will be incomplete. Worse, it will give rise to the opportunity of a kind of arbitrage based on the changes in the regulatory environment. As opportunities for a fast buck close down in one sphere, they can open up in others. As Rahm Emmanuel said, there are people who will never let a crisis go to waste. And that’s always the danger.

Join the conversation as a VIP Member