In an essay today for the new Gatestone Institute, I shred President Obama’s claim that strategic tensions in the Middle East are to blame for higher oil prices. In fact, his administration is to blame, for suppressing drilling and shale development in North America.

“Right now the key thing that is driving higher gas prices is actually the world’s oil markets and uncertainty about what’s going on in Iran and the Middle East, and that’s adding a $20 or $30 premium to oil prices,” President Obama said March 23. It’s complete and utter nonsense. Oil is trading in lockstep with expectations for economic growth, as reflected in stock prices. There’s not a shred of evidence that geopolitical uncertainty has added a penny to the oil price. Obama’s $20 to $30 per barrel risk premium is a number pulled out of a hat, without a shred of empirical support. In effect, the President is blaming Israel for high oil prices.

On April, 3, Vice-President Biden blamed higher oil prices on “talk about war with Iran”; fear that Iran might “take out the Saudi oil fields and Bahraini oil fields”; the Arab Spring movement; “war in Libya”; the rise of the Muslim Brotherhood; and a potential for unforeseen political unrest, such as “chaos in Russia.” It’s all complete and utter nonsense. Oil prices are going up because the world economy is consuming more oil and supply has not increased to meet the demand – in part because the Obama administration discourages North American energy development, most recently by stopping the proposed Keystone pipeline from Canada. It’s easier to blame foreign phantoms for high gas prices at the pump than the administration’s business-killing politics

One might argue that the market should price strategic risk into the oil price, but the fact is that markets are not especially good at assigning prices to possible events whose probability can’t be measured.

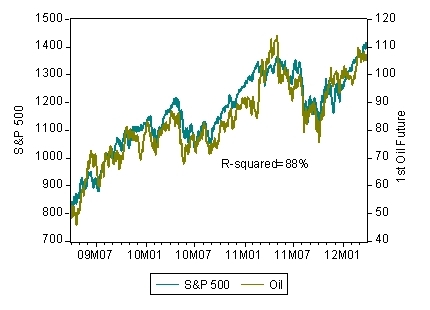

Chart 1: Oil Price vs. S&P 500, Past Three Years

Source: Bloomberg

During the past three years, oil prices have tracked equity prices almost perfectly, with a regression coefficient of nearly 90%. (For statisticians, the correlation of daily percentage changes in the two markets is 51%). Equity prices embody expectations of future economic growth, and higher growth means more demand for oil. If oil supply cannot keep up with demand—because the Obama administration has restricted development, among other factors—the oil price goes up.

Read it all here. One might add that if it were the case (and I think it eventually will be the case) that strategic tension drives up the oil price, it would also be Obama’s fault, because American strategic withdrawal exacerbates such tensions.

Join the conversation as a VIP Member