In a new essay at Law and Liberty, I characterize Bidenomics as “paranormal.” Here’s a teaser:

US government debt now stands at $20 trillion, or roughly 100% of GDP. This should be a concern, but Democratic economists are not worried. A much-discussed November 30 paper by former Treasury Secretary Lawrence Summers and former Council of Economic Advisors Chairman Jason Furman suggests that Democratic thinking has veered into the paranormal, with an emphasis on levitation. Governments will be able to borrow and spend as much as they want for whatever purpose they want, the authors argue in so many words, and interest rates will remain low forever.

As Washington Post editorialist Charles Lane commented Dec. 7, “Far from burdening future generations, governments have a golden opportunity to fund long-standing needs by borrowing for investments in future prosperity—the list includes child care, early education, job training and clean water.”

The argument so easily refuted by casual reference to the facts that it takes a doctorate from Harvard (which both Summers and Furman hold) to suspend disbelief in the obvious. The authors aver:

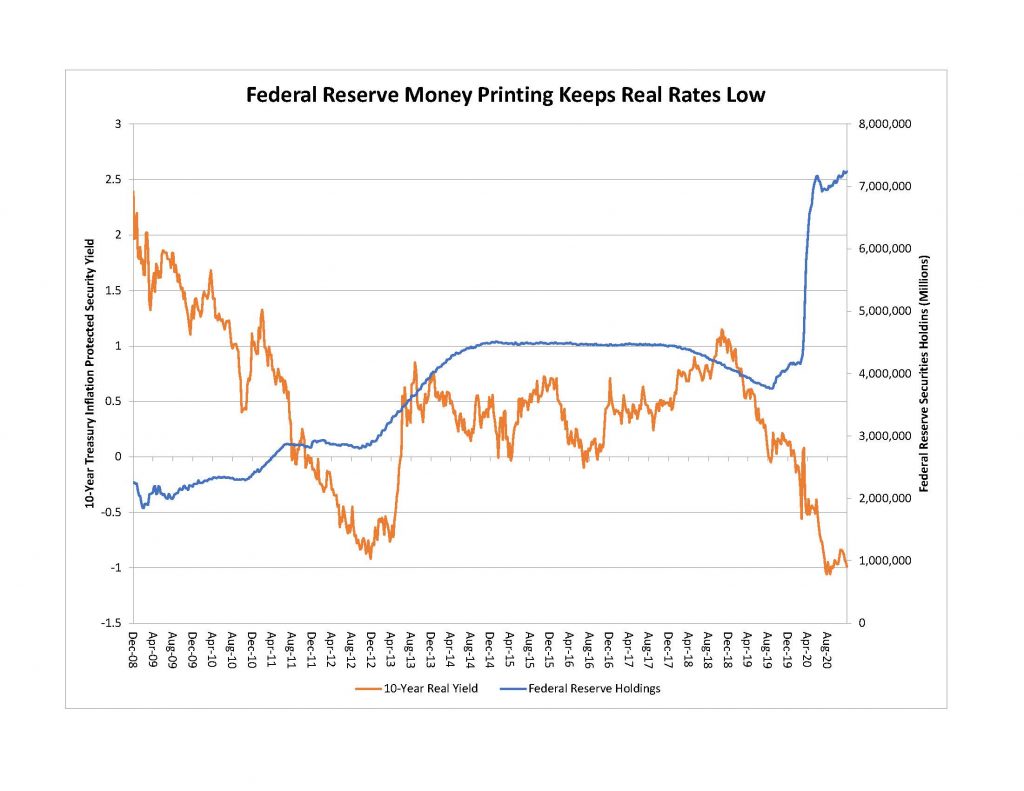

We note that with massive increases in budget deficits and government debt, expansions in social insurance, and sharp reductions in capital tax rates, one would have expected to see increasing real rates if private sector behavior had remained constant. We suggest that changes in the supply of saving associated with lengthening life expectancy, rising uncertainty and increased inequality along with reductions in the demand for capital associated with demographic changes, demassification of the economy, and perhaps changes in corporate behavior have driven real interest rates down. This characterization is rather like Hamlet without the Ghost, for the ghost in the interest machine during the past decade has been the Federal Reserve Board’s multi-trillion-dollar purchases of Treasury and agency securities. Summers and Furman do not mention this in their 50-page excursus.

The collapse of real Treasury yields to the negative 1% range during the course of 2020 had nothing to do with the savings rate, but rather with the Federal Reserve’s unprecedented purchases of public debt.

If the United States were to issue debt in order to rebuild its industrial base and reduce the current account deficit, increased debt might be justified. That is not the form that deficit spending is likely to take under a Biden administration, which is likely to offer lip service to investment in technology while spending lavishly on social and environmental programs.

The whole essay can be found here.

Join the conversation as a VIP Member